AS HISTORIC NEW FORECLOSURE LAWS TAKE EFFECT APRIL 15th, KLEIN FIGHTS FOR NEXT LEVEL OF PROTECTIONS FOR HOMEOWNERS

Jeffrey D. Klein

April 14, 2010

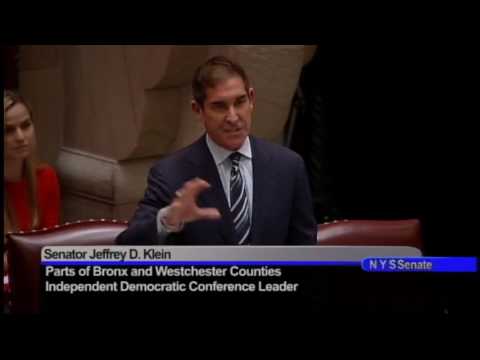

Senator Klein Releases Public Service Announcement to Alert New Yorkers to Dangerous Loan Modification Scams

ALBANY, NY – With new, vital provisions of his foreclosure legislation scheduled to take effect on Thursday, April 15th, State Senator and Deputy Majority Leader Jeff Klein (D-Bronx/Westchester) called for the next level of protections for New York State homeowners on Wednesday. Earlier this year, Senator Klein unveiled new legislation aimed at significantly decreasing, and in some cases eliminating, the pervasive practice of loan modification scams.

Senator Klein released the following public service announcement to alert New York residents of these dangerous and persuasive scams, and to urge the Senate to passage his legislation.

Protecting Your Money: Avoid Foreclosure Scams http://www.youtube.com/watch?v=EtMVt_n0ID0

“In the past few years, thousands across New York State have lost their homes to foreclosure. By putting a disclaimer on these scam notices, we get the word out wider and faster to struggling homeowners that the services they are looking for can be provided free of charge. I urge my Senate colleagues to join me in fighting for the immediate passage of this bill,” said State Senator and Deputy Majority Leader Jeffrey D. Klein (D-Bronx/Westchester).

Klein’s bill (S.5896/NYS Assembly companion bill A. 9784) requires all companies advertising as loan modification companies to include a disclaimer on all advertisements alerting consumers that they can receive the same services for free through the New York State Banking Department.

Currently under the New York State Real Property Law 265-b, New York State regulates distressed property consultants and the terms and requirements they must abide by or risk prosecution by the Office of the Attorney General. Under Senator Klein’s bill, a company that fails to display this disclaimer on their advertisements will be subject to the enforcement of the Attorney General as laid out in RPL 235-b.

In June 2009, the FBI revealed that more than 2,000 companies nationwide allegedly scammed troubled homeowners with fake “rescue” offers. That’s a 400-percent increase from 2005. The Federal Trade Commission also launched an investigation of nationwide online and print advertisements offering mortgage foreclosure rescue assistance and discovered that about 70 separate companies were running questionable advertisements

Starting April 15th, homeowners and communities affected by foreclosure will be protected in new and important ways as vital provisions of landmark foreclosure laws take effect. Included are key provisions taken from Klein sponsored legislation, among them a new law (S66007, Section 6) which requires banks to clean and maintain properties they already own, known as Real Estate Owned Properties (REOs), as well as properties that enter a judgment of foreclosure and sale. Banks will carry that responsibility until ownership is transferred through the closing of a title in foreclosure, or other disposition, and the deed for the property has been recorded. If a tenant currently occupies the property, the law states banks must also keep the property in a safe and habitable condition. The obligation may be enforced by any tenant, board of managers of a condominium or homeowners association where the property is located.

In addition to requiring banks to maintain foreclosed properties, the law also includes expanding the 90-day notice requirement to all distressed borrowers, expanding the mandatory settlement conference to include all loan types and requiring lenders, services and assignees of mortgage loans to make regular data filings with the NYS Superintendents of Banks.