Bonacic: Give Taxpayers a Bill of Rights

John J. Bonacic

February 24, 2010

-

ISSUE:

- Budget

SENATOR BONACIC’S PLAN TO STOP WASTEFUL SPENDING AND RESTORE ACCOUNTABILITY TO STATE GOVERNMENT.

CONSTITUTIONAL SPENDING CAP - Enacting a constitutional spending cap that would limit year-to-year State spending increases. This cap would force state government to live within its means. The Senate, in 2008 passed a State spending cap. Unfortunately, last year, the new, Democratic controlled Senate Majority enacted a budget with $15 billion in increased spending – blowing a giant hole in the very spending cap plan many of those same Senators voted for. Senator Bonacic voted against the 2009 budget with its massive spending increase.

PROPERTY TAX CAP – In 2008, the Senate Republicans passed a school property tax cap bill that would place a cap on the growth of school property taxes at four percent or 120 percent of Consumer Price Index (CPI), whichever is less. Too often, schools propose spending hikes well beyond the cost of living increase – even as State and Federal aid to schools has increased substantially over the years.

NO UNFUNDED MANDATES OR UNNECESSARY REGULATIONS – The Senate Republican’s Taxpayer Empowerment Plan takes a strong stand against unfunded state mandates on school districts and local governments, and would eliminate costly and often unnecessary state regulations that drive up costs for businesses and cost jobs.

Ban On Unfunded Mandates -- The ban on unfunded mandates would prevent the Legislature from imposing a mandate whose fiscal implications are greater than $10,000 to a municipality, or in excess of $1 million when combined statewide. This would virtually eliminate the need to ever grow government at the local level again.

In addition, Senate Republicans have proposed and passed legislation to encourage local governments to consolidate or share services to reduce costs and ease the burden on property taxpayers.

TWO-THIRDS MAJORITY VOTE TO INCREASE TAXES –

Senator Bonacic believes that any state tax of fee increase should be approved by at least a two-thirds "supermajority" vote of each house to pass and be sent to the Governor for consideration. Last year, $15 billion was added to the State budget – more than 10% by a vote of 32 to 30 in the State Senate. Had the 2/3 requirement been in law – as Senator Bonacic first proposed in 2008, that massive tax and spending increase, which Senator Bonacic voted against, would not have passed.

Sixteen states currently require either a supermajority vote or more than a simple majority to pass tax increases as a way to ensure that any tax increase is absolutely necessary and deserving of bipartisan support.

California requires a two-thirds Legislative vote to approve tax hikes. In 2004, Democrats there undertook a major campaign for a ballot proposal to repeal the two-thirds requirement. Voters defeated the ballot proposal and overwhelmingly supported keeping the supermajority vote requirement as a protection for taxpayers.

INITIATIVE AND REFERENDUM –

This proposal would amend the State Constitution to allow for direct initiative and referendum, whereby measures are placed on the ballot at the November general election for a popular vote after a certain number of signatures are collected. More than half the states currently have some form of Initiative and Referendum.

Under the Senate proposal, signatures from five percent of the total voters statewide in the last gubernatorial election would be required. To ensure that a measure has a broad base of statewide support, these signatures would be required to include at least 5,000 signatures of residents from at least three-fifths of the State's congressional districts.

Once on the ballot, an initiative or referendum would become law if it receives a majority of the votes cast. The bill also allows for initiative and referendum at the county, city, town or village level.

Just last year, voters in California used their right to place questions on the ballot to defeat five budget proposals that would have increased taxes, spending and borrowing.

Share this Article or Press Release

Newsroom

Go to Newsroom

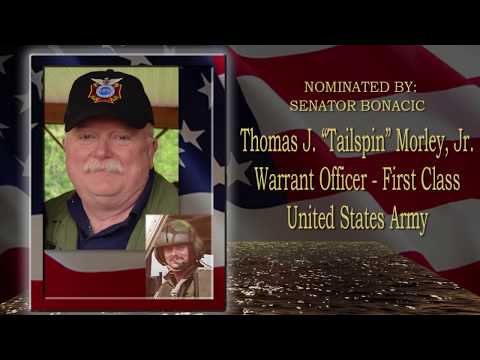

Thomas J. "Tailspin" Morley, Jr.

May 15, 2018