Sampson: Take Advantage Of The Earned Income Tax Credit (EITC) This Tax Season

John L. Sampson

February 4, 2010

Free Tax Preparation Sites Will Help Qualified Taxpayers

BROOKLYN, New York: State Senator John L. Sampson is urging qualified taxpayers to use the federal income tax program called the Earned Income Tax Credit (EITC) this tax season and take advantage of free tax preparation assistance. This program targets people who work but do not earn high incomes and has been very successful over the years.

“The Earned Income Tax Credit program has a number of important features that directly benefit taxpayers. Qualified taxpayers can save money by having their tax returns prepared for free and may even be able to file them on-line at no cost. This keeps hundreds of dollars in the pockets of working families. You don’t have to shell out substantial sums of money to a tax preparation firm or accountant nor do you have to have part of your tax refund utilized as a fee payment. I am urging all suitably qualified taxpayers to take advantage of the EITC program this tax season,” Senator Sampson said.

The earned income credit (EITC) is a tax credit for certain people who work and have low wages. A tax credit usually means more money in your pocket. It reduces the amount of tax you owe. The EITC may also give you a refund.

To claim the EITC on your tax return, you must meet all of the following rules:

- Must have a valid Social Security Number

- You must have earned income from employment or from self-employment.

- Your filing status cannot be married, filing separately.

- You must be a U.S. citizen or resident alien all year, or a nonresident alien married to a U.S. citizen or resident alien and filing a joint return.

- You cannot be a qualifying child of another person.

- If you do not have a qualifying child, you must:

- be age 25 but under 65 at the end of the year,

- live in the United States for more than half the year, and

- not qualify as a dependent of another person

“Married persons with qualifying children earning up to $48,000 can get refunds of over $4,000. Unmarried persons earning up to $18,000 a year can also qualify for the EITC program. This is beneficial for college students who do part-time work and seniors supplementing their fixed incomes by working temporary or part-time jobs,” Sampson said.

In New York City individuals can cal 311 to find free tax preparation sites. To learn more about the EITC program and check if you qualify you can go to www.IRS.gov

Share this Article or Press Release

Newsroom

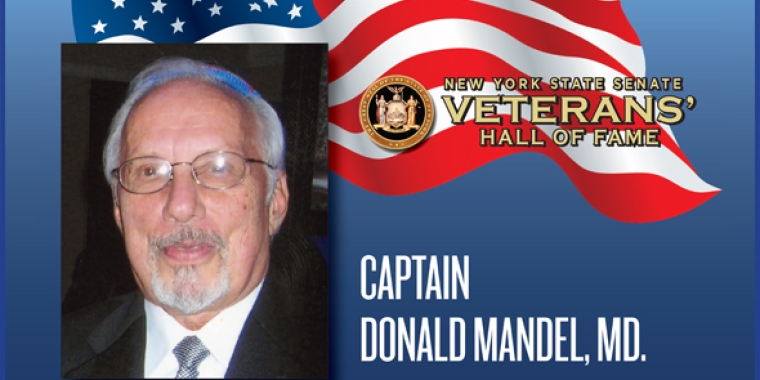

Go to NewsroomDr. Donald Mandel

May 18, 2012