Senate Enacts Tax Relief for Surviving Spouses

Malcolm A. Smith

February 24, 2010

Senator Smith: Disable Spouses to Qualify for Enhanced STAR

(ST. ALBANS, NY)- Disabled widows and widowers will continue to receive enhanced STAR property tax breaks under legislation approved by the Senate, announced Senate President Malcolm A. Smith.

The bill (S262A) supported by Senator Smith extends enhanced STAR property tax exemptions to disabled survivors upon the loss of a spouse who previously qualified for the program. The surviving spouse must be at least 62 years old.

I am advocating a comprehensive property tax relief program, but it is good to continue to take small steps such as this, streamlining the law and eliminating this particular burden,” said Senator Smith.

Information about the STAR program is available from the Office of Real Property Services, or by visiting http://www.orps.state.ny.us/star/faq.htm.

Share this Article or Press Release

Newsroom

Go to NewsroomSpring / Summer Newsletter 2013

June 4, 2013

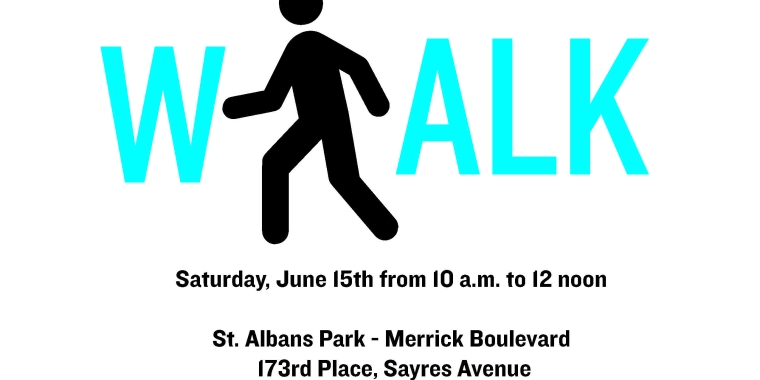

5th Annual Health Walk on June 15

May 31, 2013