Senate Passes Legislation that will Eliminate the MTA Payroll Tax

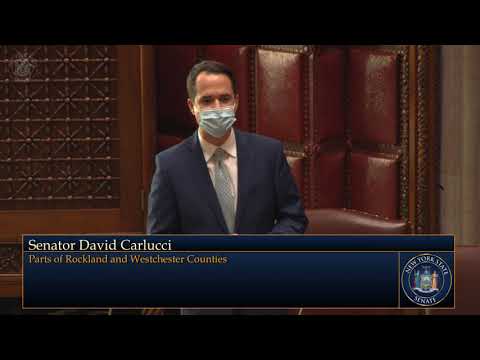

David Carlucci

June 21, 2011

The New York State Senate passed legislation (S5596A) co-sponsored by Senator David Carlucci (D-Rockland/Orange) that will repeal the job killing MTA Payroll Tax.

“This is a job killing onerous tax that never should have been implemented,” Senator Carlucci said. “New York State needs to become much more business friendly, incentivizing businesses to open and operate here rather than chasing them out of state with oppressive taxes. Eliminating this ill conceived tax will provide some relief to our overburdened small business owners.”

This legislation will phase out the MTA payroll tax, eventually eliminating it completely. The phase out schedule is as follows:

As of January 1, 2012, small businesses with twenty- five employees or less, as well as public and non-public schools throughout the entire Metropolitan Commuter Transportation District (MCTD), which includes Suffolk, Nassau, Westchester, Rockland, Orange, Putnam and Dutchess, will be completely exempted from the payroll tax.

Beginning on January 1, 2014, the payroll tax, for the seven suburban counties within the MCTD will have their tax rates reduced to .23%.

In 2013, the tax will be further reduced to .12% .

On January 1, 2014, the payroll tax within the MCTD will be fully repealed.

Within New York City’s five boroughs, the tax would be reduced to .28% on January 1, 2013 and .21% beginning on January 1, 2014. The payroll tax would remain in effect at the .21% rate for New York City’s five boroughs.

###

Share this Article or Press Release

Newsroom

Go to Newsroom