Property tax cap signed into law in Western New York

George D. Maziarz

July 5, 2011

-

ISSUE:

- Property Tax

After signing the new property tax cap legislation into law today during a visit to Western New York, Governor Andrew Cuomo gave Senator George Maziarz, a strong advocate for tax relief, one of the pens he used to write his name on the document.

Under the new law, property tax increases will be capped at 2 percent or the rate of inflation, whichever is less. Local communities and local voters could override the cap with a 60 percent vote on the budget for school boards or relevant legislative bodies.

This cap on property taxes includes safeguards to ensure delivery of critical services for New Yorkers. There will be limited exceptions to the cap, including:

- · Judgments or court orders arising out of tort actions that exceed 5 percent of the localities' levy

· Certain growth in pension costs where the system's average rate increases by more than 2 percentage points from the previous year; the amount of contributions above the 2 percentage points will be excluded from the limit

· Growth in tax levies due to economic development

The new law institutes a property tax cap to protect homeowners and businesses from skyrocketing property tax hikes for the first time in New York history. For more than 15 years, both houses of the Legislature along with three governors have talked about a property tax cap for New York's overburdened homeowners with no results. New York's property taxes are among the highest taxes in the nation:

- · The median U.S. property tax paid is $1,917; in New York, it's $3,755 – 96 percent higher than the national average

· As a percentage of personal income, New York has the highest local taxes in the nation – 79 percent above the national average

· From 1998 to 2008, property tax levies in New York grew by more than 73 percent – more than twice the rate of inflation during that span

· Companies pay five times more in property taxes than they do in corporate taxes

· New York – especially Upstate New York – continues to hemorrhage population and jobs at a greater rate than the national average

Share this Article or Press Release

Newsroom

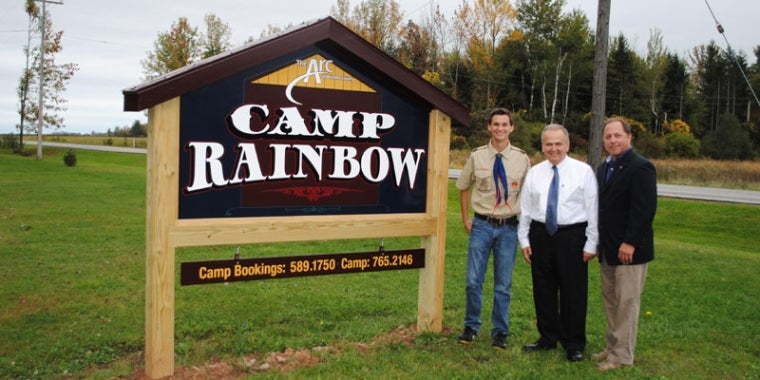

Go to NewsroomEagle Scout helps Camp Rainbow

October 8, 2013

Senator Maziarz pay tribute to New York State veterans

October 8, 2013

Summit for Smarter Schools is widely attended

October 3, 2013