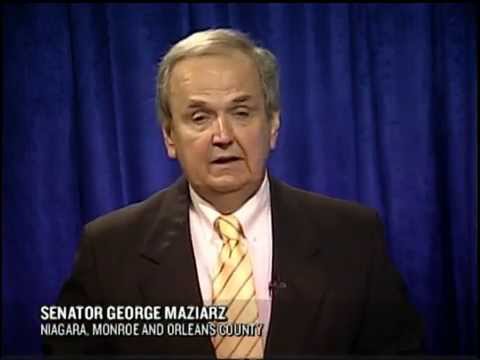

Senate approves property tax cap, mandate relief

George D. Maziarz

February 1, 2011

High property taxes are forcing people and jobs out of our state. We must create a better climate for economic growth, and having more control over property taxes is critical to that goal. More than eight in ten New Yorkers agree that the property tax cap is a step in the right direction. That is an overwhelming majority, and we owe it to them to act.

I am happy to be working with Governor Cuomo to bring about a property tax cap in New York. Today I voted in favor of the proposal he asked the Legislature to adopt. Now that the Senate has taken action on the Governor’s plan, I hope the Assembly will follow suit.

The Senate has passed and I have voted for at least two previous versions of a property tax cap, only to have the legislation fall on deaf ears in the other chamber. Hopefully, under the Governor’s leadership, this year will be different.

We also know it simply not workable to cap property tax increases and ignore their underlying causes. Therefore I’m pleased that our push for the property tax cap is being done in the right context—in the context of mandate relief. The Senate also approved legislation today to end the shameful practice of requiring school districts and municipal governments to provide certain services or comply with certain requirements with no financial help from the state.

The Senate has listened to the people of New York and taken action. Now we need our partners in government to join us.

If these two measures become law, we will have achieved real and historic reforms in the way our government functions. When these measures become law, we will be well on the way to turning New York back into a state that is known for being business-friendly and taxpayer-friendly.

#####

Share this Article or Press Release

Newsroom

Go to NewsroomYour Voice with Senator Maziarz

June 12, 2014