Senate Acts to Make Roads Safer Help Residents Obtain Star Tax Benefits

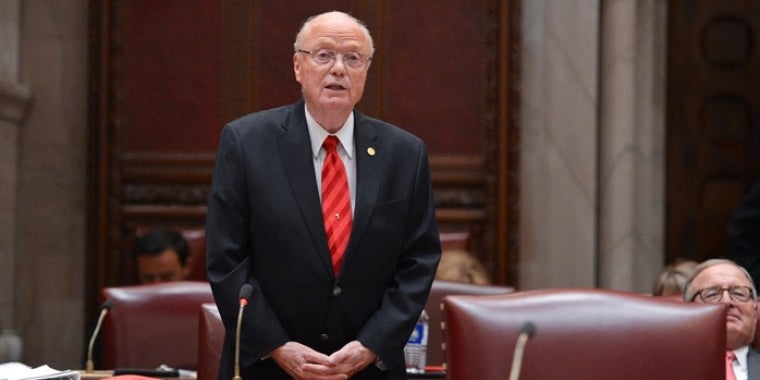

Hugh T. Farley

May 5, 2011

State Senator Hugh T. Farley (R, C, I - Schenectady) and his colleagues in the New York State Senate passed 18 bills on May 3rd that covered a variety of topics including the strengthening of penalties and prohibitions for dangerous driving, as well as helping certain property owners receive the STAR tax exemption benefits for which they are eligible.

Dangerous Driving

Two of the bills would make roads safer and give law enforcement important tools to prosecute those who are impaired while driving. Bill S.600A clearly defines "" and "" as a state of mind, notwithstanding the intoxicant. Currently, individuals can be charged with a DWI offense only if they are intoxicated or impaired by alcohol or by one of the drugs listed in the public health law. This legal loophole allows those who ingest substances not listed in the law (such as inhaling an aerosol can) to escape being charged with DWI. This would ensure that all intoxicated drivers can be charged with DWI, regardless of the substance they use.

Bill S.526A builds upon existing drunk driving laws to require the court's consent to do a case-by-case examination of the issuance of a conditional license following a DWI charge. On February 22, 2009, Suffolk County Police Officer Glen Ciano was killed after being hit by a vehicle driven by Jose Borbon, who had been charged with Driving While Intoxicated and had a conditional license issued just 30 days after the charge. Both bills have been sent to the Assembly.

Other legislation passed today that would protect drivers and make our roads safer includes a strengthening of existing laws preventing texting-while-driving. The bill, S.939, will make it easier for law enforcement to crack down on texting-while-driving offenses, increases penalties and would help prevent tragic accidents caused by drivers distracted by texting. The bill has been sent to the Assembly.

Seniors and Others Helped in Claiming STAR Benefits

Legislation (S.3576) also passed today and will help make it easier for property owners to claim STAR benefits if they missed the March 1st filing deadlines. This is particularly important to senior citizens, who must remember to file for the enhanced STAR exemption each year. Missing the deadline, and therefore the exemption, could result in a homeowner facing an unexpected and significantly increased tax bill. This bill instead authorizes municipalities to accept STAR applications after the locality’s taxable status date and before January 10th of the following year.

The bill has been sent to the Assembly.

Share this Article or Press Release

Newsroom

Go to Newsroom