Senate Passes Historic Tax Cap, Mandate Relief Legislation to Provide Tax Relief

Jack M. Martins

June 27, 2011

-

ISSUE:

- Local Government

- Property Tax

-

COMMITTEE:

- Local Government

As the hours of this legislative session wound down, the New York State Senate The New York passed an historic property tax relief legislation that enacts a cap on the growth of local property taxes. The bill, which includes both the tax cap and mandate relief, has been signed into law by the Governor.

The bill (S.5856), sponsored by Senate Majority Leader Dean G. Skelos and co-sponsored by Senator Jack M. Martins, will cap school and local government taxes to less than two percent or the Consumer Price Index (CPI), whichever is lower. Mandate relief is also included, with $127 million in savings to local governments, in addition to the creation of a Mandate Relief Council to identify and repeal unsound, unduly burdensome laws and regulations.

“Time and again, people have told me that we have to provide property tax relief. The two percent tax cap serves as a reminder that we all have to show fiscal discipline. Easing the property tax burden on our taxpayers is key to getting our economy back on track as we move forward. When went to Albany this legislative session, we promised to deliver property tax relief and tonight, we delivered on that promise,” said Senator Martins.

“Getting a property tax cap in place is critically important for every family that struggles to pay their taxes and for every business that wonders if it can afford to stay in New York,” Senator Skelos said. “Enactment of this bill into law will be a victory for homeowners who want to put a stop to skyrocketing property taxes. Senate Republicans have been fighting for years to get a tax cap enacted into law and this year, working with the Governor, we were able to get it done.”

This tax levy cap would shift the focus from total spending to the actual property taxes levied to support school district and local government expenses. The bill includes the following provisions:

· This bill limits tax levy growth to the lesser of two percent or the annual increase in the CPI.

· The exceptions for a tax levy above two percent or CPI are funds needed to support voter-approved capital expenditures, pensions, torts over five percent of the prior year’s levy, and an override of the cap.

· This bill also allows the growth in the levy due to physical and quantitative change.

· A school district would be required to submit a tax levy proposition for approval by voters at the district's annual meeting on the 3rd Tuesday in May. If the proposed tax levy is within the district's tax levy limit, then a majority vote would be required for approval. If the proposed tax levy seeks to override the cap and exceeds the district's tax levy cap, the threshold required for approval would be 60 percent of the vote.

· A school district that does not levy an amount up to the cap in any one year would be allowed to carry over unused tax levy capacity into future years. However, this carryover levy capacity cannot be used to increase its tax levy by more than an additional 1.5 percent above the cap in any single year.

· In the event a district's actual tax levy exceeds its authorized levy due to clerical or technical errors, the erroneous excess levy must be placed in reserve to offset the levy for the next school year.

The bill also provides for the same cap to apply to taxes levied by municipal governments. Local governments that do not levy an amount up to the cap in one year can rollover that amount up to 1.5 percent in the following year. Local boards can exceed the cap with a 60 percent vote of the governing body. Exceptions include the pension and tort judgments in excess of five percent from the prior year’s levy. When enacted, the law would take effect for the 2012-13 fiscal year.

As the chair of the Senate Standing Committee on Local Government, Senator Martins led the way in pushing for relief from state mandates that are passed down onto the backs of local governments and school districts. As a result, mandate relief will accompany the tax cap.

“It’s appropriate that the property tax cap and mandate relief were included in the same bill. While the tax cap will provide fiscal discipline, mandate relief will help our local governments and school districts contain their costs. The bill provides for $127 million worth of mandate relief as well as the creation of the Mandate Relief Council to identify and review mandates that can be eliminated or reformed. The Mandate Relief Council has the potential to provide billions in relief as local governments and school districts seek relief from costs being handed down from Albany,” said Senator Martins. “This is a significant step but we need to continue to seek ways of providing significant relief from state mandates, which will result in real tax relief for our residents and businesses."

In addition, the mandate relief component would provide real cost savings in the form of $127 million in savings to local budgets. This includes:

· $70 million for all local governments and school districts through piggy-backing and centralized contracts;

· $34.6 million in savings for school districts;

· $13 million for transportation/housing/contracting/procurement/administration for all localities;

· $7.9 million in social services savings for counties; and

· $1.5 million in criminal justice savings.

The establishes a Mandate Relief Council which will:

· Determine if a statute or regulation is unsound, unduly burdensome, or costly;

· Establish procedures for repealing unfunded mandates in both statute and regulation;

· Provide a mechanism for direct appeals from the State Administrative Procedures Act petition;

· Require the state Comptroller to issue a detailed report on the cost and effect of unfunded mandates;

· Require that all bills that require a local government or a school or special district to take any action contain a fiscal note; and

· Be comprised of 11 members nominated by the Governor and Legislature: two nominations for each of the legislative leaders, and seven nominations for the Governor, including the Secretary to the Governor (who would serve as chair), the Governor’s Counsel, Secretary of State, Director of the Division of Budget, and three additional members from the Governor’s executive chamber staff.

Share this Article or Press Release

Newsroom

Go to NewsroomSenator Martins Meets With Great Neck Village Officials Association

November 5, 2015

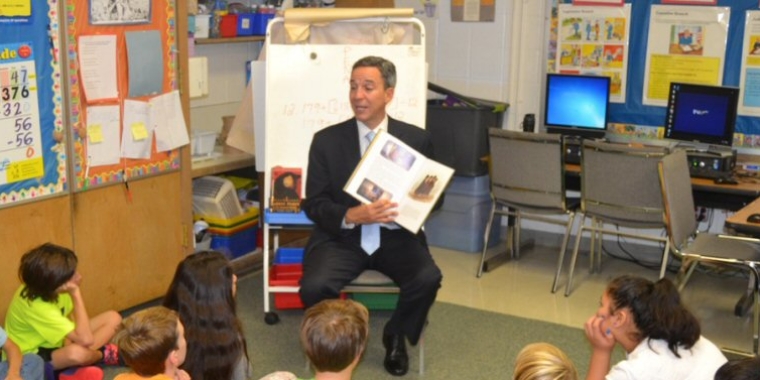

Senator Martins Reads to Manorhaven Fifth Graders

November 4, 2015