Senator Martins Fights for Mandate Relief to Accompany Tax Cap

Jack M. Martins

June 29, 2011

-

ISSUE:

- Local Government

- Property Tax

-

COMMITTEE:

- Local Government

On Friday night, June 24, the New York State Senate passed landmark legislation that was negotiated between the Senate, Assembly and the Governor. The new law will call for a 2 percent tax cap on municipalities and school districts to ease the property tax burden for taxpayers across the state. A significant part of the legislation was mandate relief that Senator Jack M. Martins, chair of the Senate Standing Committee on Local Government, fought to include as part of the tax cap bill.

Mandates handed down from the state on school districts and local governments, which are not funded by the state, are ultimately passed on to the taxpayers. Easing some of these burdens will help bring tax relief to Long Island property owners.

“I have always maintained that mandate relief has to included in the discussions on a tax cap. School districts and municipalities must be given the means by which to meet the tax cap. The end result will be tax relief for all of our property owners,” said Senator Martins.

The mandate relief package calls for the creation of the Mandate Relief Council. The council will be made up of 11 members nominated by the Governor and Legislature. The duties and powers of the council will be as follows:

- Identify and review statutes and regulations, and upon request of a local government or a member of the council, make a determination whether a mandate is unsound, unduly burdensome or costly. In making such review and determination, the council must consider such mandates in light of cost benefit principles.

- The council would be authorized to determine whether a statute or regulation is unsound, unduly burdensome or costly. Such determination would be made upon a majority vote of the council.

- A determination review would be triggered by a request of a city, town, village of county government, a school district or special district (each limited to three requests per year) or a request of a member of the council.

- The council would make its determination upon such a request or submission.

-The council would meet regularly upon the call of the chair and six members would constitute a quorum.

“For years, concerns about unfunded mandates have fallen on deaf ears. This new law will change that,” said Senator Martins. “Since I have a background in local government, I know the challenges they face. That’s why I felt it was so important to push for this legislation. The Mandate Relief Council has the potential to provide millions of dollars in relief as local governments and school districts seek relief from costs being handed down from Albany.”

Share this Article or Press Release

Newsroom

Go to NewsroomEnd Jew-hatred rallies against systemic antisemitism at CUNY

September 15, 2023

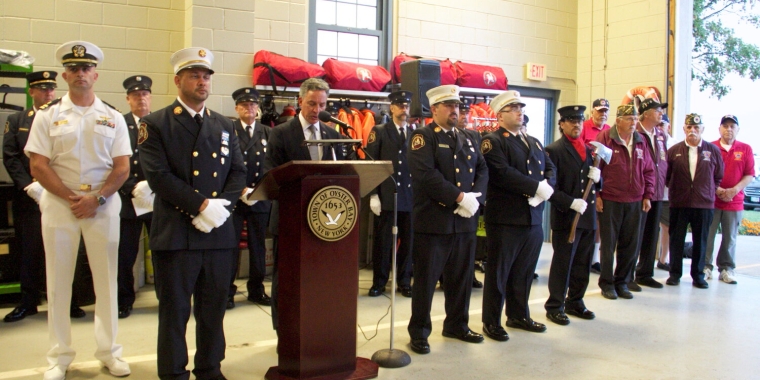

A soulful ceremony on Sept. 11 in Oyster Bay

September 15, 2023