School Tax Relief Program (STAR) Application Deadline March 1, 2011

John A. DeFrancisco

February 11, 2011

I want to remind you that the deadline for New York

State’s School Tax Relief Program (STAR) is March 1, 2011. STAR is a tax

relief program that lowers property taxes for owner-occupied primary

residences. There are two levels of STAR benefits: Basic STAR and Enhanced

STAR.

Basic STAR is available to residents who own and live in their own 1- ,2- ,

or 3-family house, condominium, or cooperative apartment and earn less than

$500,000 a year. There is no age limit for Basic STAR. For qualifying

homeowners, Basic STAR exempts the first $30,000 of the full value of a

home from school taxes. Once you are approved for Basic STAR, you need not

reapply each year unless you move to a new primary residence.

You may already have the Basic STAR exemption, but if you turn 65 any time

in the year 2011, you may be eligible for the Enhanced STAR exemption. In

addition to being 65 or older, you must own property that you use as your

primary residence, and the total annual income of all the owners of the

property must be $79,050 or less, based on 2009 Income Tax Returns. If

you meet these qualifications, you must complete a separate application for

Enhanced STAR and file by March 1, 2011. For qualifying seniors, Enhanced STAR exempts the first $60,100 of the full value of their home from school taxes.

If you file an annual state income tax return, you may also be eligible to

enroll in the STAR Income Verification Program, in which you can authorize

the New York State Department of Taxation and Finance to verify your income

eligibility each year. Please ask your assessor about this program. If

you qualify for the enhanced benefit but choose not to enroll in the STAR

Income Verification Program, you must reapply each year for the Enhanced

STAR Program.

The STAR Program is locally administered by your town assessor’s office

where you may acquire and file your application between January 1st and

March 1st. A link to applications for residents of Onondaga County, including the City of Syracuse, can be found at the bottom of this page.

The amount of your STAR benefit is set every year by the State

and is based on the type of property you own. The benefit on your tax

bill, therefore, may vary each year.

Property Exemptions for Onondaga County Residents:

Share this Article or Press Release

Newsroom

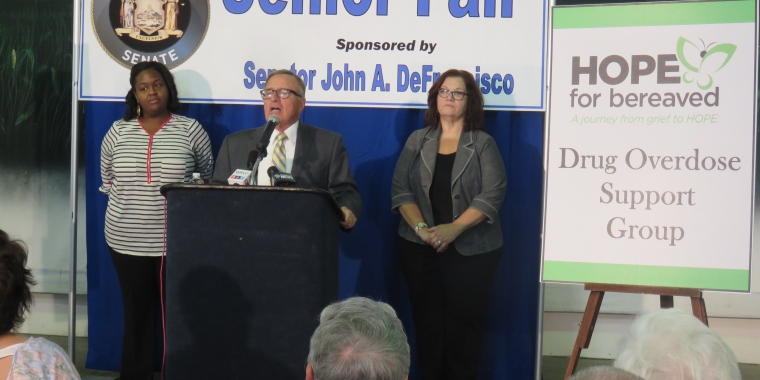

Go to NewsroomSenator DeFrancisco Holds 12th Annual Senior Fair

September 29, 2016

GOVERNOR CUOMO SIGNS TIFFANY HEITKAMP’s LAW

August 17, 2016