Long Island Business News Supports MTA Payroll Tax Repeal Legislation

Lee M. Zeldin

June 10, 2011

-

ISSUE:

- Payroll Tax

Albany, NY- Senator Lee M. Zeldin (R, C, I –Shirley) announced that the Long Island Business News wrote an editorial in today’s paper supporting his and Senator Jack Martins’ MTA Payroll Tax Repeal legislation (S.5596/A.8193).

Long Island Business News: Editorial: Right track

by the Editors

Published: June 10, 2011

The Republican delegation of the New York Senate is behind a push to repeal the onerous MTA payroll tax. The bill, introduced by state Sens. Lee Zeldin, R-Shirley, and Jack Martins, R-Mineola, would phase out the tax over a three-year period.

Starting Jan. 1, 2012, small businesses and nonprofits with fewer than 25 employees would be exempt from the tax, as would all schools. Businesses with more than 25 employees in the seven suburban counties would have the tax rate reduced to 0.23 percent beginning on Jan. 1, 2012, reduced further to 0.12 percent for 2013 and then completely repealed as of Jan. 1, 2014.

The forecasted savings to Long Island taxpayers is estimated at $220 million per year, money that can be put back into the local economy, while the plan’s projected impact on the MTA amounts to less than 2 percent of its operating budget.

According to a release from Sen. Martins’ office, “the Senate and Assembly believe that the leadership of MTA can find savings to offset the payroll tax.”

We are in total agreement. While the tax was imposed in 2009 as a measure to bail out the struggling MTA, the transit authority has not used the money to either increase efficiencies or serve its constituents. One is example is the LIRR’s failure to plan for a major service outage, such as the one that occurred after a small electrical fire in an antiquated control tower in a Jamaica switching station last August stopped service on 10 branches and left thousands of commuters stranded.

More importantly, most employees of Long Island companies don’t use the railroad. So why should local businesses be forced to bear the expense of the tax?

This proposal couldn’t have come at a more opportune time. As our economy begins its slow recovery, we should not be bailing out organizations that continue to prove their inefficiency, but instead should be encouraging growth by reducing the tax burden on companies and individuals.

“The Long Island Business News today announced that our MTA Payroll Tax repeal legislation is on the right track,” said Senator Zeldin.

“Not only do they understand the need for us to enact this legislation swiftly as the economy rebounds, but they also are in agreement with what Senator Martins and I have been saying since introducing this legislation, that the MTA, without increasing fares or cutting services, can balance its books after this legislation is implemented. I have identified over a dozen potential ways for the MTA to cut expenses to balance its books,” continued Senator Zeldin.

“I thank the Long Island Business News for their forward thinking support. They know that one of the best ways to improve our Long Island economy is to get rid of this job-killing tax as soon as possible.”

Share this Article or Press Release

Newsroom

Go to Newsroom2013 Legislative Session Overview

July 29, 2013

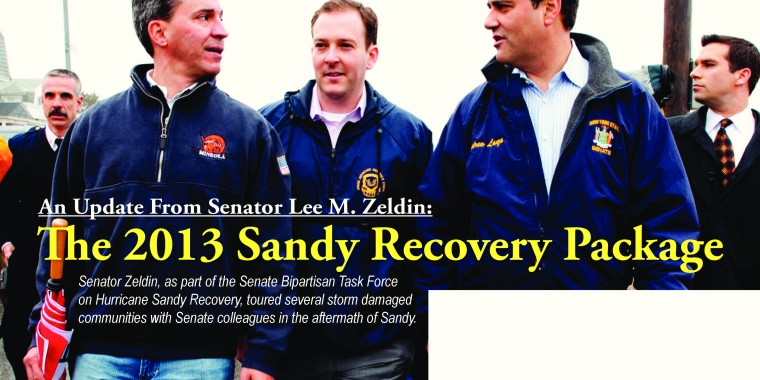

The 2013 Sandy Recovery Package

July 10, 2013