Governor Cuomo Advises New Yorkers to Prepare for Property Damage and Losses as Hurricane Irene Approaches

Martin J. Golden

August 26, 2011

Encourages New Yorkers to Review Insurance Information, Keep Emergency Claim Numbers Readily Available, Watch out for Scams

Governor Andrew M. Cuomo today urged homeowners to prepare for the potential economic impact of Hurricane Irene by reviewing their insurance policies, gathering emergency claim numbers, securing insurance information and watching out for potential scam artists looking to take advantage of the potential disaster.

"Homeowners should do everything they can to prepare their property to prevent damage. But there are things you can do before the storm to make it easier to deal with damage from a hurricane if it does happen," Governor Cuomo noted. "Consumers should consider taking steps to protect themselves now. Developing a home inventory, assembling information on your insurance policies and understanding what to do should a disaster affect you are things that can better prepare anyone against losses from a storm."

Benjamin Lawsky, Superintendent of Department of Financial Services, who oversees the Department of Insurance added, "Our Department stands ready and prepared to help and protect New Yorkers' assets. New Yorkers should take prudent measures now, before the storm hits, to ensure they can quickly and easily file claims for any damage."

The Governor listed the following practical suggestions:

Review Your Insurance Policies

Make sure you know what is covered by your policy and what is not covered. Call your insurance agent or company if you have any questions. Remember that flood damage is not covered by standard homeowners or renter's insurance and must be covered under a separate flood insurance policy. Flood insurance does not go into effect for 30 days, so it is too late to obtain this insurance for Hurricane Irene. But if your area could be subject to flooding, you should consider obtaining this protection for the future.

It's Not Too Late to Create a Home Inventory

It's important to have a detailed list that catalogs the belongings in your home with such information as cost and date of purchase. A sample inventory form is on the Insurance Department's website: http://www.ins.state.ny.us/homeown/pdf/home_invchklst.pdf.

If you don't have time to create a comprehensive list of the items in your home, then quickly videotape and/or photograph every room. The more detail you include, the easier it will be for your insurance company to evaluate your loss. When making your list, make sure to open drawers and closets, and don't forget to take stock of what's in your garage and storage buildings. Photograph a newspaper or magazine in at least one of the pictures to document the date the photos were taken.

Consider keeping a duplicate copy of your inventory and photo record at a location away from your home. This could be with a relative or trusted friend where the information is accessible yet away from the potential disaster area.

Collect and Store Your Insurance Information

Keep copies of your insurance policies with your home inventory records. Make sure to have a copy of the policy declarations page listing all of your coverages, as well as your insurance cards. It's important to have 24-hour contact details for your insurance agent and insurance company, along with your insurer's website and mailing addresses. It's a good idea to store this information in a waterproof, fireproof box or safe, and if you need to evacuate your home, don't forget to take this information with you.

Prepare for the Worst

There are steps you can take to help mitigate some of the damage caused by a hurricane or tropical storm. If your home is equipped with storm shutters, make sure you can quickly put them in place. Clear your yard of debris that could become projectiles in high winds and trim dead or overhanging branches from trees surrounding your home. It's also a good time to make a quick review of your home to make sure the roof sheathing is properly secured, that end gables are securely fastened to the roof, and that doors and garage doors are latched properly.

For personal safety, identify the nearest storm shelter and have an evacuation plan for your family. Also, make sure you have hurricane survival supplies including: bottled water, a first aid kit, flashlights, a battery-operated radio, at least three days of non-perishable food items, blankets, clothing, prescription drugs, eyeglasses, personal hygiene supplies and enough cash for at least three days.

If you are forced to evacuate your home, turn off all utilities and disconnect appliances to reduce the chance of additional damage and electrical shock when utilities are restored.

For more information about how to prepare your family and home for the threat of tropical storms or hurricanes, visit the American Red Cross' website or download their Hurricane Safety Checklist.

After the Storm

The days following a natural disaster can be confusing and stressful, but it is important that you focus on filing your insurance claim(s) as quickly as possible to help protect your financial future.

The first step to getting your home restored is to contact your insurance company and/or agent with your policy number and other relevant information. Be aware that your policy might require that you make this notification within a certain time frame.

Take photographs/video of the damage before clean-up or repairs. After you've documented the damage, make repairs necessary to prevent further damage to your property (cover broken windows, leaking roofs and damaged walls). DO NOT have permanent repairs made until your insurance company has inspected the property and you have reached an agreement on the cost of repairs. Be prepared to provide the claims adjuster with records of any improvements you made prior to the damage. Save all receipts, including those from the temporary repairs.

If your home is damaged to the extent that you cannot live there, ask your insurance company or insurance agent if you have coverage for additional living expenses.

Ask what documents, forms and data you will need to file the claim. Keep a diary of all conversations you have with the insurance company and your insurance agent, including names, times and dates of the calls or visits and contact details.

Be certain to give your insurance company all the information they need. Incorrect or incomplete information may cause a delay in processing your claim.

If the first offer made by the insurance company does not meet your expectations, be prepared to negotiate. If there is a disagreement about the claim, ask the company for the specific language in the policy in question and determine why you and the company interpret your policy differently. If you believe you are being treated unfairly, contact the Insurance Department at: www.ins.state.ny.us. You can file a complaint about an insurance company at:

http://www.ins.state.ny.us/complhow.htm.

Protect Yourself From Home Repair Fraud

Home repair fraud increases exponentially following a major storm. Protect your investment by getting more than one bid from contractors and requesting at least three references. Ask for proof of necessary licenses, building permits, insurance and bonding. Record the contractor's license plate number and driver's license number, and then check for any complaints with the

Better Business Bureau. Finally, be wary of contractors who demand up-front payment for repairs. If the contractor needs money to buy supplies, go with the contractor and pay the supplier directly.

Homeowners Resources

The Insurance Department's online "Homeowner's Resource Center" offers detailed information and a number of useful tools consumers may find helpful. It can be found at the following location on the Insurance Department's website, http://www.ins.state.ny.us/hmonindx.htm.

The Insurance Department will activate the Insurance Emergency Operations Center to work with insurance companies to help consumer with claims as soon as the storm is over. The Department has already notified homeowners' insurance companies to prepare. In addition, the Department is contacting health insurers and requesting that they make accommodations for consumers who are forced to leave their homes because of the storm and as a result have to seek health care from out-of-network providers.

Consumers should contact their insurance company, agent or broker to get answers to specific questions about their policies. Consumers who need further help should feel free to contact the New York State Insurance Department's Consumer Services Bureau at 1-800-342-3736 which operates from 9:00 AM. to 4:30 PM., Monday through Friday. Disaster related calls only should go to the disaster hotline at 1-800-339-1759, which will be open starting Monday from 8:00 AM to 8:00 PM for as long as needed.

Share this Article or Press Release

Newsroom

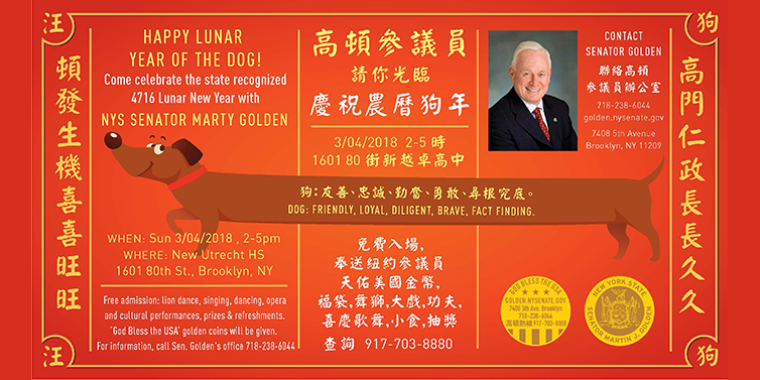

Go to NewsroomHappy Lunar Year of the Dog!

February 26, 2018

Annual Easter Egg Hunt

February 26, 2018