Senate Passes Legislation to Give Tax Credit to Families Who House Seniors or the Disabled

Martin J. Golden

May 5, 2011

-

ISSUE:

- Aging

Sen. Golden’s sponsored bill would grant tax exemption on property assessments

Albany- State Senator Martin J. Golden (R-C-I, Brooklyn) this week led New York State Senate passage of S. 638, which he sponsored, that amends the current property tax law to exempt homeowners, who make renovations on their homes to accommodate seniors or the disabled, from an increased assessed value.

Senator Marty Golden stated, “I joined with my colleagues in the Senate in providing a common sense solution to New York homeowners. Currently facing one of the highest home owner taxes of any state in the country, homeowners in our great State need solutions to our tax burden. This legislation will prevent people who make adjustments to their homes in order to house senior or disabled members of their family from having to pay a higher assessment.”

Golden continued, “Seniors and disabled persons who live with their family save the State money, as they are not living in community assisted living, and therefore those savings should and will be passed onto the homeowners. More importantly, family members who care for elderly or disabled relatives, allow them the opportunity to age and be cared for in their home or in a home of a relative.”

This legislation empowers the local municipalities to change their tax laws to provide an exemption from increased value of residential property resulting from the construction or reconstruction of their property for the purpose of providing living quarters for a parent or grandparent, who is 62 or older or for any person with a disability.

This legislation will save New York tax payers a significant amount of money. This tax exemption will provide a safer, more family oriented environment for loved ones that might otherwise be living in state funded and subsidized living facilities.

The bill was sent to the Assembly.

Share this Article or Press Release

Newsroom

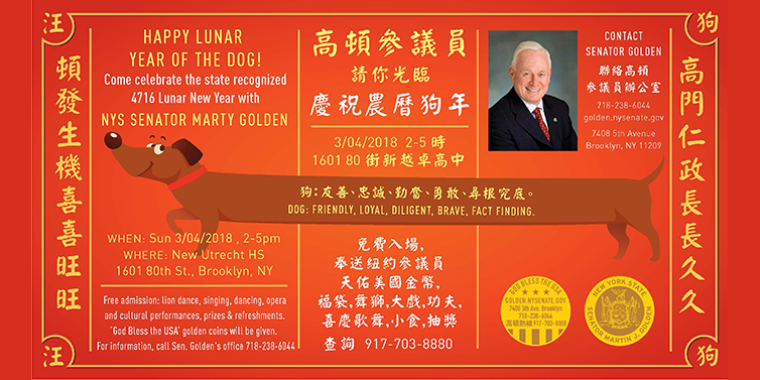

Go to NewsroomHappy Lunar Year of the Dog!

February 26, 2018

Annual Easter Egg Hunt

February 26, 2018