Senator Golden, Senate Finance Committee Member, Votes to Create a New York Spending Cap in an Effort to Turn State’s Economy Around

Martin J. Golden

January 20, 2011

-

ISSUE:

- Finance

Albany- State Senator Martin J. Golden (R-C-I, Brooklyn), who last week was appointed as a member of the New York State Senate Finance Committee, today voted to support legislation (S. 1892) that would enact a two percent state spending cap.

This will be the third time that Senate Republicans have voted to pass a state spending cap that ensures New York spends no more than taxpayers can afford. The cap, which would be set at 2 percent or 120 percent of the CPI (currently 1.9 percent), whichever is lower, would ensure that the state reduces spending and lives within its budget, easing the burden on taxpayers.

Senator Martin J. Golden stated, “The spending cap is needed more than ever because of the $11 billion deficit caused by years of overtaxing and overspending. The unchecked growth in spending has resulted in New York having the highest tax burden in the nation. Thirty states currently have some kind of a spending cap. New York must enact a cap now to force fiscal responsibility and enable us to reduce taxes so to keep families here in the Empire State.”

The legislation would cause year-to-year State spending increases to be limited to 120 percent of the Consumer Price Index (CPI) or 2 percent, whichever is less. In any given year, fifty percent of tax revenue that exceeded the cap would be placed in a reserve fund and fifty percent would be returned to taxpayers in the form of direct tax rebates.

If the state spending cap was in place now the state would be forced to reduce projected spending next year by $9 billion, forcing the budget gap to be solved without raising taxes. Had the state spending cap been in place for the past 10 years the state would be spending $30 billion less next year.

In addition, the proposal would require the Executive to resubmit a balanced Budget to address any shortfalls in revenue that occur after the submission of the Executive Budget, and make any necessary spending revisions to reflect the declining revenue.

The constitutional spending cap proposal would give the Executive the authority to exceed the cap in the event of a fiscal emergency or other extraordinary circumstances, however, the Comptroller would be required to independently certify the financial crisis.

According to a report by the National Conference of State Legislatures, thirty states have put in place statutory or constitutional tax or spending limits.

Share this Article or Press Release

Newsroom

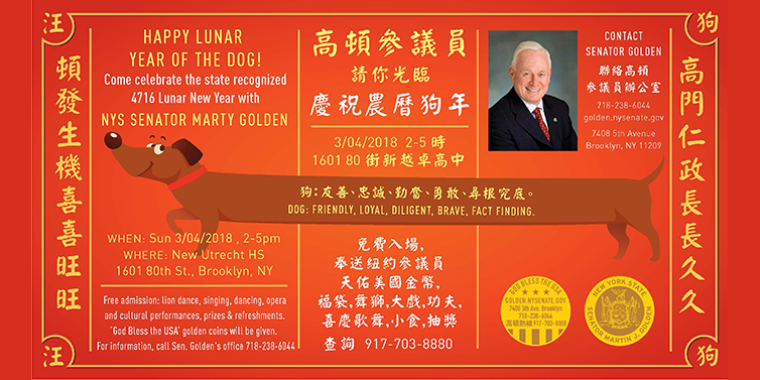

Go to NewsroomHappy Lunar Year of the Dog!

February 26, 2018

Annual Easter Egg Hunt

February 26, 2018