Taxpayer Advocate

Shirley L. Huntley

May 10, 2011

News From New York State

Senator Shirley L. Huntley

For Immediate Release: May 11, 2011

Contact: Bryant G. Gaspard| gaspard@nysenate.gov | (518) 455-3531

Senator Huntley Acts to Protect Taxpayers by

Passing ‘Office of the Taxpayer Advocate’

“Taxpayer Advocate Act” to provide voice for taxpayers and reshape state bureaucracy

Senator Shirley L. Huntley (D-Jamaica) announced the New York State Senate passed the “Taxpayer Advocate Act” (S. 1072), which will create the Office of the Taxpayer Advocate in order to aid taxpayers in their dealings with the State Department of Taxation and Finance, identify and resolve taxpayer problems, suggest legislative solutions, and prevent hardship while ensuring a fair and consistent application of tax laws and policies is conducted.

“New York’s taxpayers need help – and right now they need an ally, which is exactly what the Taxpayer Advocate will be to them,” Senator Huntley said. “Our federal governments, and several other states, have already realized the benefits of this office now it’s time to bring it to our State. Taxpayers will now have someone who’s sole duty is to identify the problems they face and fight for the solutions they need.”

Modeled after the Internal Revenue Service’s (IRS) Taxpayer Advocate office, New York’s version ensures there is an official role of a trusted arbiter on behalf of citizens – against the government – to help protect taxpayers from inefficiency within state bureaucracy.

The duties of the Taxpayer Advocate will be to:

• Assist taxpayers in resolving problems with the tax department;

• Identify areas in which taxpayers have problems dealing with the department;

• Propose solutions, including administrative changes to departmental practices and procedures;

• Recommend legislative action;

• Promote communication;

• Prepare an annual report by December 31 to identify initiatives taken, summarize the 15 most serious taxpayer problems, describe actions taken and not taken on behalf of each taxpayer, and recommend administrative and legislative action to resolve taxpayer problems.

The borough of Queens is notable for being one of the most diverse communities in the world; as such there are many people who are recent immigrants and/or English is not their first language. Understanding and completing your taxes can sometimes be a complicated and daunting task, especially for those who are not acclimated to the New York State and federal government tax system.

The Taxpayer Advocate Act will be beneficial to residents of Queens due to the fact they will help explain tax issues and help find solutions to whatever problems taxpayers may have.

The senator continued, “As taxpayers, we’ve all had to deal with complex issues and unfortunately the current system is tedious and downright irrational. However, the Taxpayer Advocate will help cut through the bureaucracy and help us ensure taxpayers are being properly served by their government.”

Additional news available at http://huntley.nysenate.gov and facebook.com/Shirley L. Huntley

New York State Senate Email | shuntley@nysenate.gov | (518) 455-3531

Share this Article or Press Release

Newsroom

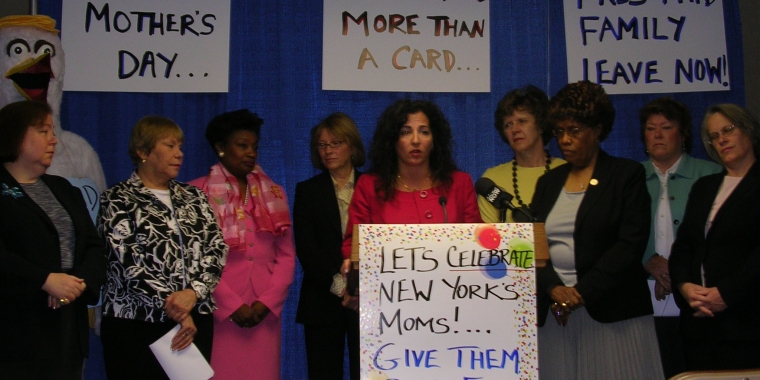

Go to Newsroom5/07/2008: Paid Family Leave Act

May 7, 2008

4/09/2008: Session

April 9, 2008

A First Step

March 19, 2008