MANDATE RELIEF SHOULD DELIVER TAX RELIEF The Governor’s Mandate Relief Preliminary Report falls short of providing real relief

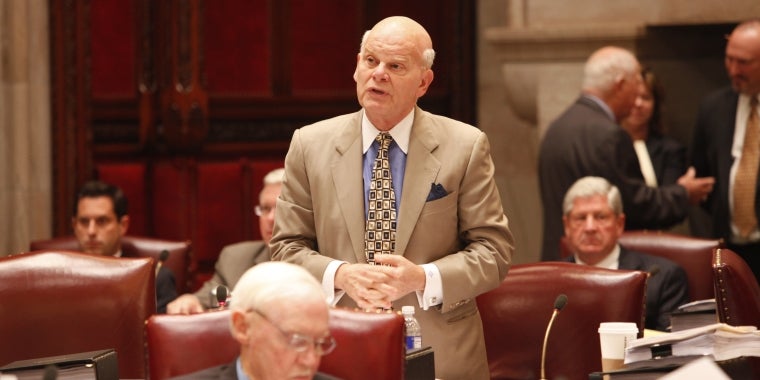

Stephen M. Saland

March 3, 2011

-

ISSUE:

- Taxes

Shortly after taking office, the Governor announced the creation of the Mandate Relief Redesign Team and charged them with the task of reviewing existing state mandates and identifying mandates that are ineffective and outdated. I was encouraged that the Governor made it abundantly clear that the path to tax relief needed, in part, to be achieved through mandate relief. For years, dating back to 1993, I have sponsored several measures to eliminate unfunded mandates. Many of the bills I sponsored over the years passed with bipartisan support and in fact, the last three Governors incorporated my mandate relief bill language into their Executive Budget proposals as a means to reduce local property taxes. I have long held that state and federally imposed mandates are a tremendous strain on municipal and school budgets and as a result, taxpayers continue to bear the brunt of the burden. And when serving as the Senate Education Chairman for six years, I refused to consider any legislation which contained an unfunded mandate.

The Preliminary Report, released this week, offered a number of recommendations, that if enacted, would save considerable time and money at the local and state level. I am encouraged that the centerpiece of the report is to adopt a constitutional amendment which embraces my legislation, passed as recently as this year, prohibiting new unfunded mandates.

While I agree wholeheartedly with the statement contained within the report that unfunded mandates cannot be solved in sixty days, I also recognize that much more needs to be done to address the current fiscal crisis.

School districts and local governments are facing double-digit percentage increases in their pension obligations and although the creation of a new retirement system certainly achieves a long term savings, it does nothing to alleviate the current burdens.

Further, it is reported that the Team raised a number of long discussed but unresolved issues such as health insurance employee cost sharing, special education reform, Medicaid costs and the Triborough Amendment (a provision in law that allows certain public employees to continue to receive automatic pay raises even in the absence of new contract) but in their Preliminary Report, no recommendations were made, citing the complexity of the issues and the need for further review and discussion.

While I well understand and agree the issues raised but not addressed are complex, they are widely viewed as the mandates associated with the steepest expenditures.

It is my hope that the Mandate Relief Team recognizes the importance of confronting these challenging issues swiftly and has an open, public discussion on the savings that can be achieved if all parties work together to deliver tax relief.

To shelve or delay tackling these issues during our economic crisis may result in a missed opportunity to rein in the costs that place the largest burden on the local taxpayer. For mandate relief, the future is now.