Senator Saland Announces Passage of Property Tax Cap and Mandate Relief Bills in the State Senate

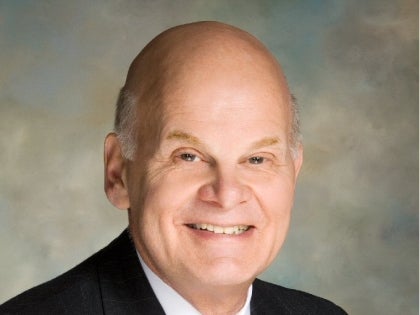

Stephen M. Saland

January 31, 2011

-

ISSUE:

- Property Tax

Senator Steve Saland (R,I,C – Poughkeepsie) announced the passage of Governor Cuomo’s real property tax cap bill in the State Senate. The imposition of a property tax cap will benefit local taxpayers by limiting the annual tax levies imposed by school districts and local governments.

The bill limits the local tax levies to 2% or 120% of the consumer price index, whichever is less. Exceptions to the cap include support for capital expenditures approved by the voters.

“One would have to be deaf not to hear the taxpayers’ cry for relief,” said Senator Steve Saland. “Over the last few decades, local property taxes far outpaced the rate of inflation and it’s critical to many homeowners and businesses that we stem the flow of rising taxes. I am encouraged that we have the support of Governor Cuomo who has demonstrated a commitment to partner with us in our efforts to provide tax relief.”

In addition to the property tax cap, the State Senate enacted a bill to provide mandate relief to schools and localities. Senator Saland, who has a long history of being a vocal advocate for mandate relief, sponsored the bill which prohibits the mandates imposed on local governments and school districts without sufficient appropriations from the State.

“We need a responsible government, both at the federal and state levels, that considers costs before imposing mandates and strives to address the current fiscal burdens. When schools and local governments are saddled with unfunded mandates, taxpayers are saddled with higher taxes. If we expect municipalities and school districts to function within the confines of a tax cap, the State should be doing all that it can to give them the flexibility to operate efficiently, which should include the removal of various costly and onerous existing mandates,” said Senator Steve Saland.

Share this Article or Press Release

Newsroom

Go to Newsroom50 Employers Register for Job Fair in City

September 18, 2012

9/11 Memorial Service - Senator Stephen Saland

September 11, 2012