Senator Carlucci Unveils College Affordability Plan

David Carlucci

October 15, 2012

-

ISSUE:

- Education

Will Reduce Skyrocketing Tuition Expenses for Middle Class Families; Grants New Incentives for Savings, Increases Transparency

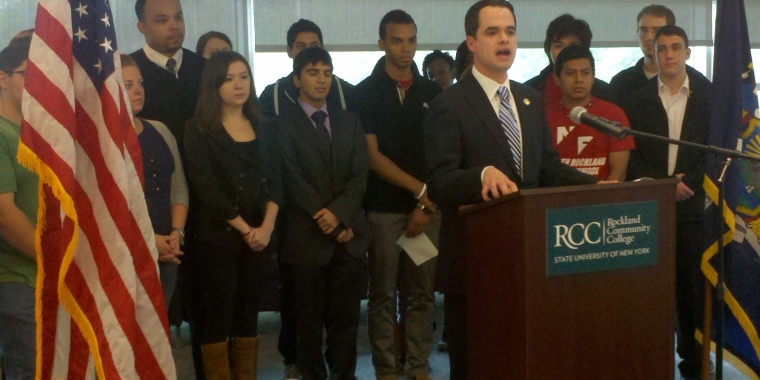

SUFFERN, NY – As the cost of tuition for colleges and universities continues to soar at alarming rates throughout the country, Senator David Carlucci (D-Rockland/Orange) today announced legislation (S.7449A) he has co-sponsored that will make higher education more affordable so that students and their families will not be saddled with debt for years after graduation.

Joined by students, parents, and school administrators at Rockland Community College, Senator Carlucci highlighted legislation that is geared towards expanding education tax credits, providing low-cost student loans, increasing private lender transparency, and increase savings for families by allowing for pre-paid tuition.

The problem with rising tuition is nothing new. In a 2011 article entitled Rising College Costs Price Out Middle Class by CNN Money, and using data compiled by the College Board and IRS data, tuition and fees at public universities had surged almost 130% over the last 20 years while middle class incomes have stagnated.

In fact, in 1988, the average tuition and fees for a four-year public university cost about $2,800, adjusted for inflation. By 2009, that number rose about 130% to roughly $6,500 a year – without the cost of books or room and board.

“Rising tuition expenses have become a national phenomenon that is drowning the middle class year after year,” said Senator Carlucci. “These numbers clearly show an unsustainable path towards paying for college education, and now is the time to offer real solutions so that we can properly invest in our children’s future while doing it at an affordable price.”

Over the last decade, according to the College Board, college costs continued to increase dramatically. At public four-year colleges, costs rose an average of 4.9% per year, at private not-for-profit four-year institutions costs increased an average of 2.7% per year and at public two-year colleges tuition and fees rose an average of 1.8%.

At the same time, public two-year colleges remained the most cost effective. For full-time students enrolled in public two-year colleges, on average, grant aid and tax benefits covered tuition and fee charges in 2011-12, leaving an estimated $810 to help students pay for books, supplies and living expenses. In other sectors, average grant aid and tax benefits did not cover the average cost of tuition and fees.

As it relates to tuition and fees, the top 25 college and universities that are the most expensive are private institutions. The most expensive university in 2012-2013 is Sarah Lawrence College, which cost $61,236 per year. New York University came in second at $56,787.

Education Tax Credits

Under the Stay in New York Tax Credit, this program is designed to incentivize students to stay in New York State who graduate from New York-based colleges and universities by offering those graduates a credit equal to their college expenses over a four-year period. The credit would be capped at $3,000 per year. The credit would be available for students who live and work in New York post-graduation, and completed community service while they are attending college.

The Tuition Tax Credit would improve New York’s Tuition Tax Credit by amending it to:

- Double the amount of qualified college expenses that can be claimed from $10,000 to $20,000 over five years

- Double the maximum amount of the credit allowed from $400 to $800 over five years; and

- Index the qualified expenses and credit to the rate of inflation of the Higher Education Price Index.

Student Loan Linked Deposit Program

This new student loan program would provide low-cost student loans by authorizing the State Comptroller to place state deposits with participating lenders at a decreased interest rate, in order to offer students reduced rate student loans, at up to 3 points below market rates.

This program provides for $100 million dollars, with repaid loan amounts going back into available deposits and loans. Loans would be available for students attending in-state colleges, for educational expenses such as tuition, fees, books, supplies and room and board). Loans would be capped at $7,500 per academic year, and cannot exceed a total amount of $30,000.

The Student Lending Transparency Program

Under this program, the Department of Financial Services would be required to collect data on student loans in order to compare loan rates and repayment plans. The superintendent would be required to use this data and create a list of private lenders who provide the best loan rates and repayment options on student loans, and place this list on a website.

The Pre-Paid Tuition Program

This bill would also establish a New York State Pre-Pay tuition savings program. This would allow parents to prepay for college tuition at SUNY or CUNY beginning when their child reaches the age of five. Parents would be able to pre-pay one third of the annual total cost of their child’s college education over a period of twelve years.

Dr. Cliff L. Wood, President of Rockland Community College, said: "We applaud these and any other effective measures ensuring access to higher education at RCC remains attainable for the families of our community."

Jordan Zuber-Banks, Sophomore Student at Rockland Community College, said: "Senator Carlucci understands the struggle that students are having with affording college tuition, and this plan will help so many of my peers that are looking for any type of relief in these difficult times."

# # #

Share this Article or Press Release

Newsroom

Go to NewsroomSmall Business Stimulus Resources

April 11, 2020

4/11 Coronavirus Update Stimulus

April 11, 2020

4/11 Coronavirus Stimulus Update

April 11, 2020