Clothing Sales Tax Exemption is in Effect

John A. DeFrancisco

June 27, 2012

-

ISSUE:

- Taxes

Your clothing and footwear purchases up to $110 dollars are no longer subject to New York state sales tax.

On April 1, 2012, the New York State sales tax clothing exemption was restored to the original less-than-$110 threshold.

This means that sales of eligible clothing and footwear, costing less than $110 per item or pair, are now exempt from the state's 4% sales tax and local tax in those localities that enacted the exemption. This new tax break could save a family of four as much as $200 dollars a year.

Share this Article or Press Release

Newsroom

Go to NewsroomSenator DeFrancisco Highlights Testimony from Tax Reform Hearings

September 19, 2013

Hotline Announced for New York's Health-Care Exchange

September 17, 2013

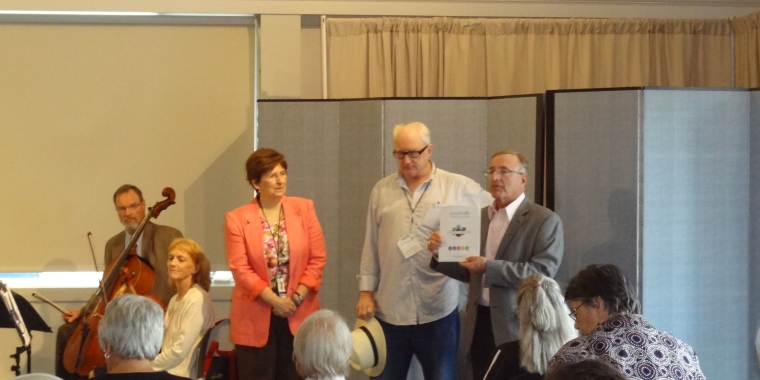

Senator DeFrancisco Celebrates Fall Concert Series at Liverpool Library

September 17, 2013

Senator DeFrancisco Speaks to Students at Owasco Elementary School

September 13, 2013