Senator Malcolm A. Smith Proposes Reparation Legislation For Victimized Homeowners

Malcolm A. Smith

February 13, 2012

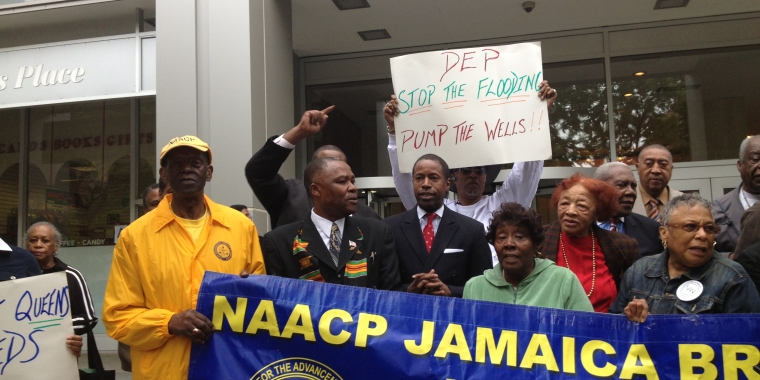

(St. Albans, NY)- In a move to address the wide-spread taint of the foreclosure process Senator Malcolm A. Smith (D-St. Albans) has proposed legislation that enhances the efforts of Attorney General Eric T. Schneiderman’s recent success in preliminary settlement recovery efforts. The State reached a settlement for $136 million with the nation's five largest mortgage services over foreclosure abuse. The settlement includes direct relief to victims of wrongful foreclosure conduct and loan modifications including principal reductions for homeowners and funds that can be used to cornerstone foreclosure legal assistance and housing counseling programs. President Obama’s unprecedented support of Attorneys General to rectify the wrongs perpetrated by major banking institutions in the United States enabled Attorney General Schneiderman to expeditiously accomplish sorely needed remedy to residents of New York State. It is in that vein that we seek economic recovery for all.

“Home purchasing is the largest single investment that individuals make in their life time. Banks committed crimes against homeowners and restitution needs to be fair. I am introducing this legislation that I believe will bring parity to my constituents in the city and State of New York. I applaud the efforts of Attorney General Eric Schneiderman to bring the banks to task for their erroneous dealings with home buyers.” Smith continued “It is the launching pad for my legislation which provides for increased financial payments to victims of the foreclosure crisis.”

Under the proposed agreement reached by the Attorneys General, homeowners will receive between $1, 500 to $2,000 in retribution for the bad mortgages. In comparison to the financial injuries suffered by homeowners these amounts are unfair and insulting. Under Senator Smith’s legislation homeowners would come closer to being made whole with the option to receive:

(a) the full amount of the down payment paid on his or her qualifying residential real property, in addition to the amount of all monthly mortgage payments associated with such property, up to and including the later of the date of the foreclosure action or discovery of the wrong;

(b) twenty percent of the original appraised value of the qualifying residential real property;

(c) if the eligible homeowner has been foreclosed upon and is no longer residing in the qualifying residential real property, the full amount of a down payment on new residential real property;

(d) if the eligible homeowner has been foreclosed upon and is no longer residing in the qualifying residential real property and has not chosen to purchase new residential real property, up to six months of rental payments.Share this Article or Press Release

Newsroom

Go to NewsroomEmmlynn L. Taylor

May 13, 2013