Da Hynes and Senator Golden Call on Albany to Reform New York’s Broken No-Fault Auto Insurance System in Wake of Arrests

Martin J. Golden

February 29, 2012

-

ISSUE:

- Insurance

BROOKLYN, New York February 29, 2011 – In response to today’s bust up of a Brooklyn-based crime ring suspected of committing health care and no-fault auto insurance fraud to the tune of $250 million, Kings County District Attorney Charles J. Hynes and Senator Martin J. Golden are again calling on Albany to act swiftly to reform New York’s broken no-fault auto insurance system.

“This latest insurance fraud scheme in Brooklyn serves as a stark reminder that New York’s no-fault auto insurance system is broken and in desperate need of reform,” said District Attorney Hynes. “Until the State Legislature makes no-fault auto insurance reform a priority, criminals will continue to fleece the system by staging auto accidents and ripping off insurance companies and honest drivers for hundreds of millions of dollars annually.”

Senator Golden said, “Yet another organized crime ring has slipped through the loopholes in our state’s broken no-fault auto insurance system. I urge my colleagues in Albany to join me in the call for reforms so that we can pass meaningful legislation and provide New York’s working families with financial relief at a time when they need it most.”

Today’s arrests reflect a growing problem concerning health care and auto insurance fraud in New York City. A recent study of personal injury protection (PIP) claims performed by the Insurance Research Council (IRC) showed that claimed losses for medical expenses, lost wages and other expenses related to injuries from auto accidents in the New York City area have risen 70 percent over the past decade – surpassing the 49 percent increase in medical care inflation over the same period. Furthermore, the average claimed loss per PIP claimant in the New York City area was more than double the average loss among claimants from the rest of the state - $15,086 compared with $6,870.

Statewide, nearly one in four (23 percent) claims in the study involved the appearance of claim abuse. Claims from the New York City area were more than four times as likely to involve apparent abuse, 35 percent compared with 8 percent in the rest of the state. The study identified Brooklyn and Queens as particular hotspots for abuse. More than half (52 percent) of apparent abuse claims stemmed from accidents occurring in either Brooklyn or Queens, while these two boroughs accounted for only 28 percent of all claims in the study.

Currently, there are no criminal statutes that deal specifically with “runners” who stage accidents, requiring prosecutors to use other criminal laws to crack down on this type of fraud. Although the State Legislature passed a law several years ago to stop fraudulent medical providers from receiving payment under the no-fault system, the regulations were never promulgated to implement the law.

Over the past year, District Attorney Hynes, Senator Golden and Fraud Costs New York – a broad-based group of elected officials, chambers of commerce, civic associations, law enforcement and insurance trade associations committed to reforming New York’s no-fault auto insurance system - have called on the State Legislature to implement reforms that would:

· Make it a Class D and E Felony to act as a ‘Runner’ and steer people to no-fault medical clinics or lawyers in exchange for monetary payments;

· Make it a Class C felony to stage an accident;

· Ensure that medical providers convicted on No-Fault fraud are prohibited from receiving future payments under the no-fault system and are subject to civil penalties;

· Require medical providers to submit disputed no-fault claims to arbitration;

· Modify the “30-day rule” to allow more time for investigation into suspicious claims;

· Combat excessive medical charges by requiring health care providers to submit evidence that services billed were medically necessary.

“I commend District Attorneys Hynes, Senator Golden and the Fraud Costs New York coalition for calling on the State Legislature to make no-fault auto insurance reform in the 2012 legislative session,” said Kristina Baldwin, assistant vice president of Property Casualty Insurers Association of America. “Without real reform, these sophisticated criminal rackets will continue to bilk the system only to leave honest ratepayers and small businesses in the red.”

Share this Article or Press Release

Newsroom

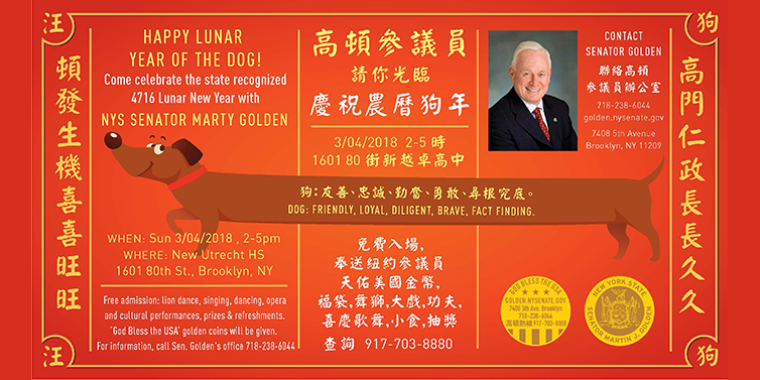

Go to NewsroomHappy Lunar Year of the Dog!

February 26, 2018

Annual Easter Egg Hunt

February 26, 2018