Senate Republicans Announce 2012 New Jobs-NY Job Creation Plan

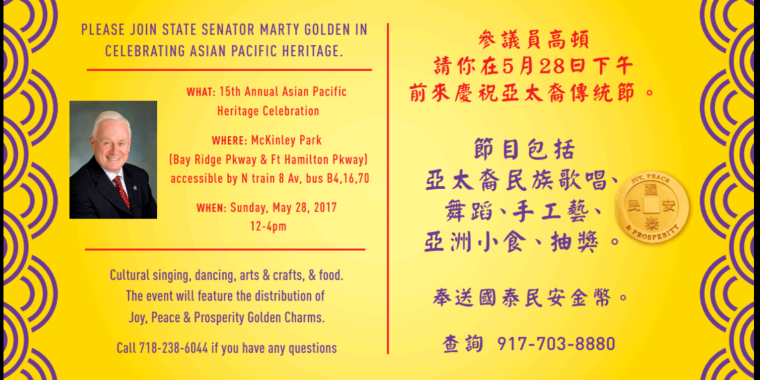

Martin J. Golden

March 7, 2012

-

ISSUE:

- Jobs & Employment

Plan Would Create Jobs, Cut Taxes and Control State Spending

Jobs Proposal Will Be Included in Senate Budget Proposal

Albany- State Senator Martin J. Golden (R-C-I, Brooklyn), today joined Senate Majority Leader Dean Skelos and members of the Senate Republican Conference, to announce details of the 2012 NEW JOBS-NY Job Creation Plan that includes significant tax relief to encourage the creation of new private sector jobs, measures to ensure fiscal responsibility and control state spending, as well as other reforms and incentives to make New York more economically competitive. The plan will be included in the Senate budget resolution to be acted on next week.

Senator Marty Golden stated "I am proud to be part of the Republican Senate Conference that will be advancing a plan that makes the economy of New York a top priority. Among the highlights of our efforts are plans to create jobs, provide tuition relief for New York families, and establish a framework in which small business can compete. I join my colleagues in opposing any tax or fee increases that may be proposed this year, and support measures that will get New Yorkers, including our veterans, back to work."

"Last year, by working with the Governor, we made great steps to reduce taxes and spending in government. Today, we once again call for government restraint on taxes and spending, as well as additional programs to provide the middle class with every opportunity deserved. Together, we can make our great city and state the greatest place to live, work, and raise a family," continued Senator Golden.

Highlights of the Senate Republican job creation plan, which is supported by statewide business organizations, including the Business Council of New York, Unshackle Upstate and the National Federation of Independent Businesses, include:

Job-Creating Tax Cuts

· 20% TAX CUT FOR SMALL BUSINESSES: The plan would provide small businesses with a corporate tax rate cut from 6.85 percent to 5.5 percent – a 20 percent reduction. It would also eliminate the fixed dollar minimum. This $65 million tax cut impacts almost 200,000 small businesses and would make our state more competitive and help create thousands of new jobs.

· SMALL BUSINESS JOBS CREDIT: The plan would also provide a 10% tax credit for about 800,000 small businesses that have at least one employee, have business income of less than $250,000, and that file under the personal income tax. This tax credit would save businesses $120 million.

· ELIMINATE SENATE DEMOCRATS 500 PERCENT ENERGY TAX HIKE: In 2009, Senate Democrats hurt New York’s economy by enacting a dramatic 500 percent hike in the 18a assessment that New Yorkers pay on utility bills. This disastrous tax hike took $1.2 billion out of the economy and chased businesses and jobs out of New York.

The new Energy Tax Cut would accelerate the phase-out of this huge tax hike by one year, from 2014 to 2013. By cutting taxes earlier than previously scheduled, we will deliver $600 million in relief and give a major boost to New York’s economy. · TUITION RELIEF FOR MIDDLE CLASS FAMILIES: The Senate Majority wants to ensure that rapidly escalating tuition costs don’t place the dreams of an outstanding higher education out-of-reach for hardworking middle class families across our State. That’s why our plan includes new reforms that would peg existing tuition tax credits and deductions to the Higher Education Price Index (HEPI).

Under the plan, the current tax deduction would increase from $10,000 to $13,820 and the maximum credit would increase from $400 to $553.· SUPPORT FOR JOB-CREATING PROJECTS: The plan also allows Tax Increment Financing (TIF) of local development projects, an innovative and fiscally responsible step to free up investment capital for major job-creating projects.

New Incentives For Job Creation

· “HIRE-NOW-NY” TAX INCENTIVE: Our Hire-Now-NY proposal includes direct incentives to encourage businesses to begin expanding their workforce again. For each new job they create, a business would get a tax credit of up to $5,000. That credit would increase to up to $8,000 if the job goes to someone on unemployment.

· “HIRE-A-VET” ENHANCED CREDIT – The Senate job creation plan would provide an enhanced tax credit of up to $10,000 to any business that hires a veteran returning home from military service.

Taxpayer Protection, Fiscal Responsibility and Regulatory Reform

· STATE SPENDING CAP: The cap, set at two percent or 120 percent of inflation, whichever is lower, would help to ensure fiscal responsibility, and provide a better environment for economic growth and job creation.

· CONSTITUTIONAL AMENDMENT TO HELP PREVENT TAX INCREASES: This constitutional amendment would require a two-thirds “super majority” vote, rather than a simple majority, for any tax increase – making it far more difficult to raise taxes.

· MORATORIUM ON NEW TAXES AND FEES: Last year, we closed a $10 billion budget deficit – without resorting to any new taxes and fees. To continue our efforts to strengthen our economic climate and help create private sector jobs, the Senate Majority is again committed to enacting a new State Budget that avoids any new taxes and fees.

· ELIMINATING JOB-KILLING REGULATIONS: Our plan includes repeal of the annual notification provisions of the “Wage Theft Prevention Act of 2010” – a duplicative and costly mandate that the previous Senate leadership imposed on employers statewide. This job-killing measure is a perfect example of unnecessary red tape that does nothing to help employees, while also hurting businesses and our economy. (S. 6063A / Passed Senate, 2/29/12)

· MAKING STATE AGENCIES MORE RESPONSIVE: For years, many small business owners have expressed concern about unresponsive state agencies – especially when it comes to the permitting process. When someone applies for a professional license or a permit, they should not be left hanging for months on end. The Honesty in Permit Processing Act (S. 2461) requires agencies to publicly disclose their response times, and to tell applicants how long they can expect to wait for approval. If approval takes more than 134 percent of the average processing time, applicants would get a refund. This will improve New York’s economic climate, empower taxpayers, and help break through bureaucratic logjams.