Legislation Authored By Senator Gallivan To Provide Property Tax Relief For Town of Evans Passes Senate Unanimously

Patrick M. Gallivan

March 1, 2012

-

ISSUE:

- Local Government

- Taxes

- Property Tax

MEASURE WILL INCENTIVIZE HOME IMPROVEMENTS, ENCOURAGE NEW CONSTRUCTION, AND COMBAT BLIGHT

Senator Patrick M. Gallivan (R,C,I – 59th District) announced that the Senate passed legislation, S.5557A (Gallivan), that provides targeted tax relief and property tax abatement for home construction in the Town of Evans.

The bill authorizes the Town of Evans to establish a partial residential tax abatement program for the improvement, modification or construction or construction of one to three family homes that raise the assessed value of the property by at least $10,000. During the first year of the program, 50 percent of the assessed value will be abated, to a maximum of $150,000. The abatement is subsequently decreased by 10 percent each subsequent year.

“Evans’ is a jewel of the Southtowns. It has miles of beautiful shoreline and beaches along Lake Erie, Evangola State Park, and is full of unique communities and neighborhoods, but for a myriad of reasons, Evans has seen residential development stagnate in recent years, while existing housing stock has deteriorated,” said Senator Gallivan. “A temporary, short-term tax abatement program can be a critical tool to reverse this trend, attract new residential development, encourage improvements to existing homes, reverse blight, and enhance the area’s quality of life.”

Senator Gallivan worked with the Town of Evans Economic Development Committee to establish a temporary tax abatement program in the Town; and the Evans Town Board, the Angola Village Board, and the Evans-Brant School District have all passed resolutions supporting the initiative.

The bill has been sent to the Assembly where it is being sponsored by Assemblyman Kevin Smardz (R – 146th District).

Share this Article or Press Release

Newsroom

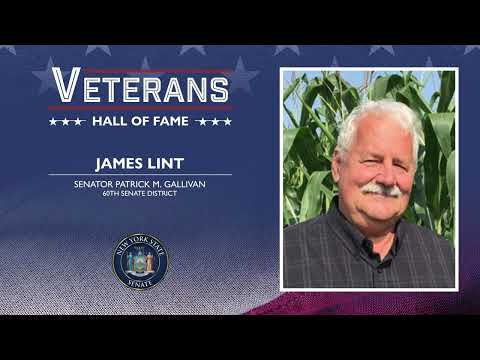

Go to NewsroomSenator Gallivan 2023 Veteran Hall of Fame

November 10, 2023

The Fight Against Breast Cancer Never Ends

October 23, 2023