Senate Ok’s Bill Easing College Costs for Middle Class Families

Patty Ritchie

June 4, 2012

-

ISSUE:

- Higher Education

Creates the “College Affordability Program”

Senator Patty Ritchie announced Senate passage of a bill to help Middle Class families with the rising cost of college tuition.

The “College Affordability Program” doubles the value of New York’s tuition tax credit and deduction, cuts interest rates on student loans, and includes an incentive to encourage graduates to stay and work in New York.

“As college costs continue to increase, we need to make every effort to help lessen the burden on students and their families,” said Senator Ritchie. “This legislation makes college more affordable for middle class families, and gives students an extra incentive to stay close to home after graduation.”

In 2001, New York became among the first states to allow a deduction or credit for college costs, but that benefit hasn’t kept pace with the rise in tuition, which has increased 47 percent since that time.

Key provisions of the Senate plan:

· A “Stay in New York” tax credit available to graduates who live and work in New York after graduation and complete community service while attending college;

· Doubling the state tuition tax deduction, to $20,000, and increasing the tuition tax credit from $400 to $800;

· Cutting interest rates in half on student loans through a new program that uses state deposit accounts to help fund student payments, and

· Improved transparency on student loans to help students and their families make better borrowing choices.

The bill, S.7449, was sent to the Assembly.

Share this Article or Press Release

Newsroom

Go to NewsroomStatement from Senator Patty Ritchie

November 23, 2021

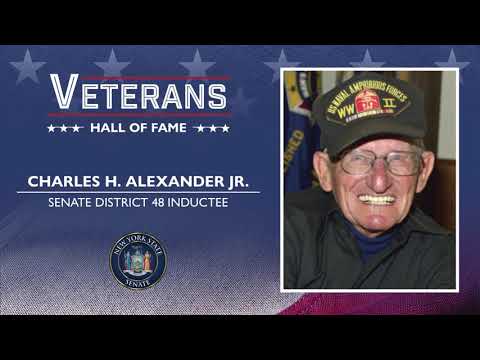

Senator Ritchie 2021 Veteran Hall of Fame

November 11, 2021

Statement from Senator Patty Ritchie

November 8, 2021