Senate Passes “New Jobs-NY” Job Creation Plan

William J. Larkin Jr.

May 30, 2012

The New York State Senate today passed the 2012 NEW JOBS-NY Job Creation Plan. The Senate’s comprehensive plan will help create thousands of new private sector jobs by delivering tax relief to small businesses and manufacturers, reducing energy costs, and enacting major fiscal reforms to make New York State more economically competitive.

“This legislation will make New York’s businesses more competitive and our business climate more attractive to new companies,” said Senator Bill Larkin (R-C, Cornwall-on-Hudson). “By passing this legislation, we are sending a strong message that we are serious about creating new jobs, retaining current jobs and opening up more opportunities throughout the state. I urge the Assembly to truly make New York “Open for Business” and pass this bill as soon as possible," said Larkin.

Senate Republicans first approved a small business tax cut plan as part of its budget resolution in early March. However, the tax cuts were not included in the enacted 2012-13 state budget.

The Senate Republican’s NEW JOBS-NY plan is supported by business organizations across the state, including the Business Council of New York, Unshackle Upstate, the Manufacturers Association of Central New York (MACNY), the National Federation of Independent Businesses, the Long Island Association and the Long Island Business Council. Highlights of the plan include:

• Eliminating Taxes on New York Manufacturers: The plan would spur creation of thousands of manufacturing jobs by eliminating income taxes paid by manufacturers over a three year period ($495 million in tax relief).

• 20 Percent Corporate Tax Cut for Small Businesses: This cut in the corporate tax rate will save nearly 200,000 small businesses $49 million.

• 10 Percent Personal Income Tax Credit for Small Businesses: This tax cut would save 800,000 small businesses $80 million.

• Significant Energy Tax Cut: The legislation accelerates the phase-out of the 500 percent energy tax hike Senate Democrats previously approved in 2009.

• New Incentives for Each New Job Created: The bill includes new job creating incentives that would give businesses a tax credit of up to $5,000 for each new job they create; up to an $8,000 credit if the new job goes to someone on unemployment; up to a $10,000 credit if a business hires a returning military veteran.

• Help for New York’s Small Brewers: The plan includes a new Production Credit and Label Registration Credit for New York’s vibrant craft brewing industry.

• A new “angel investor” tax credit to encourage investments in start-up businesses.

The overall NEW JOBS- NY job creation plan also includes fiscal reforms to improve New York’s business climate. The plan includes a state spending cap; a super-majority vote provision to make any future tax increases more difficult; and new regulatory reforms to reduce red tape for businesses.

Job-Creating Tax Cuts:

The 2012 NEW JOBS NY job creation bill (S7448) passed today includes the following provisions:

ELIMINATE TAXES ON MANUFACTURERS: Over a three-year period, the legislation would provide manufacturers throughout New York State with $495 million in tax relief – phasing out the taxes they pay under the State’s Corporate Franchise Tax and Personal Income Tax. This unprecedented step would immediately and dramatically improve the competitiveness of New York’s manufacturers, create thousands of new jobs, and provide a major economic boost to communities across the state.

20 PERCENT CORPORATE TAX CUT FOR SMALL BUSINESSES: The plan would provide small businesses with a 20 percent reduction by cutting the “small business corporate tax rate” from 6.5 percent to 5.2 percent. It would also virtually eliminate the fixed dollar minimum for small businesses. This $49 million tax cut, which would impact almost 200,000 small businesses, would make our state more competitive and help create thousands of new jobs.

SMALL BUSINESS JOBS CREDIT: The plan would also provide a 10 percent tax credit for about 800,000 small businesses that have at least one employee, have business income of less than $250,000, and that file under the personal income tax. This tax credit would help encourage new job creation by saving small businesses $80 million.

ELIMINATE SENATE DEMOCRATS 500 PERCENT ENERGY TAX HIKE: In 2009, Senate Democrats hurt New York’s economy by enacting a dramatic 500 percent hike in the 18a assessment that New Yorkers pay on utility bills. This disastrous tax hike took $1.7 billion out of the economy and chased businesses and jobs out of New York.

The new Energy Tax Cut would accelerate the phase-out of this huge tax hike by one year, from 2014 to 2013. By cutting taxes earlier than previously scheduled, we will deliver $522 million in relief and give a major boost to New York’s economy.

BREWER’S PRODUCTION CREDIT AND LABEL REGISTRATION CREDIT: In response to a recent NYS Supreme Court order which hurt a number of New York’s craft brewers, the legislation would allow a credit to small brewers for the first 200,000 barrels of beer brewed in New York, and a $150 credit for each beer label registered with the NYS Liquor authority (only for beer labels where less than 1,500 barrels are produced annually in New York.)

ENCOURAGE JOB-CREATING INVESTMENT IN START-UPS: The legislation includes a new “angel investor” tax credit program to help ensure that promising business start-ups have access to the investment capital they need to grow and expand. This provision would create an “Angel Investor” program with a pool of $7 million and also create a 35 percent angel investor credit for those businesses that donate funds to the pool.

STRENGTHEN THE FILM PRODUCTION INDUSTRY: The legislation provides support for New York’s film production industry by increasing the post-production tax credit from 10 percent to 30 percent.

“HIRE-NOW-NY” TAX INCENTIVE: Our Hire-Now-NY proposal includes direct incentives to encourage businesses to begin expanding their workforce again. For each new job they create, a business would get a tax credit of up to $5,000.

MOVING FROM UNEMPLOYMENT TO THE WORKPLACE: The Hire-Now-NY tax incentive would increase to up to $8,000 if the employer hires someone who is currently unemployed.

“HIRE-A-VET” ENHANCED CREDIT: The Senate job creation plan would provide an enhanced tax credit of up to $10,000 to any business that hires a veteran returning home from military service.

Taxpayer Protection, Fiscal Responsibility and Regulatory Reform

The overall 2012 NEW JOBS-NY Job Creation Plan also includes key fiscal reforms to make New York State more economically competitive. These bills include:

STATE SPENDING CAP: The Senate today passed spending cap legislation (S716) sponsored by Senator Joseph Robach (R-C-I, Rochester), that would limit the growth of state operating funds spending to no more than the average rate of inflation of the three previous calendar years. In addition, the bill would increase the maximum capacity of the state's rainy day reserve from 3 percent of General Fund spending to 10 percent of General Fund spending. This bill would enhance the state’s fiscal responsibility and provide a better environment for economic growth and job creation.

CONSTITUTIONAL AMENDMENT TO HELP PREVENT TAX INCREASES: This constitutional amendment would require a two-thirds “super majority” vote, rather than a simple majority, for any tax increase – making it far more difficult to raise taxes (S1919A, Senator Lee Zeldin, passed Senate 1/19/11).

ELIMINATING JOB-KILLING REGULATIONS: Our plan includes repeal of the annual notification provisions of the “Wage Theft Prevention Act of 2010” – a duplicative and costly mandate that the Senate Democrats imposed on employers statewide. This job-killing measure is a perfect example of unnecessary red tape that does nothing to help employees, while also hurting businesses and our economy. (S6063A / passed Senate 2/29/12)

MAKING STATE AGENCIES MORE RESPONSIVE: For years, many small business owners have expressed concern about unresponsive state agencies – especially when it comes to the permitting process. When someone applies for a professional license or a permit, they should not be left hanging for months on end. The Honesty in Permit Processing Act (S2461, passed Senate 3/13/12) requires agencies to publicly disclose their response times, and to tell applicants how long they can expect to wait for approval. If approval takes more than 134 percent of the average processing time, applicants would get a refund. This will improve New York’s economic climate, empower taxpayers, and help break through bureaucratic logjams.

Heather Briccetti, President and CEO of The Business Council of New York State, Inc. said: "We applaud the Senate Majority's continued focus on reducing the cost of doing business, lowering the state's business burden on business, and reducing the cost of creating jobs. This package focuses on key sectors and emerging industries, and will promote new private sector investments and critically needed new jobs."

Over the past year and a half, the Senate Majority has successfully taken a number of key steps to improve New York’s business climate to help create jobs:

> Passing two consecutive on-time state budgets;

> Closing approximately $13 billion budget deficits -- without raising taxes or fees in the budget;

> Reducing state spending for two consecutive years;

> Cutting taxes on small businesses;

> Enacting a landmark property tax cap;

> Approving the UB2020/SUNY 2020 economic development plan;

> Repealing the MTA payroll tax for 80 percent of the business that paid it;

> Enacting the Recharge-NY power-for-jobs plan and the Power-NY (Article X) power plant siting law;

> Cutting taxes for middle class families and reducing tax rates to the lowest level in more than half a century; and

> Helping to launch the NY-Works initiative to revitalize New York’s infrastructure.

Share this Article or Press Release

Newsroom

Go to NewsroomPublic Forum Announced

November 6, 2013

2013 Community Questionnaire

October 21, 2013

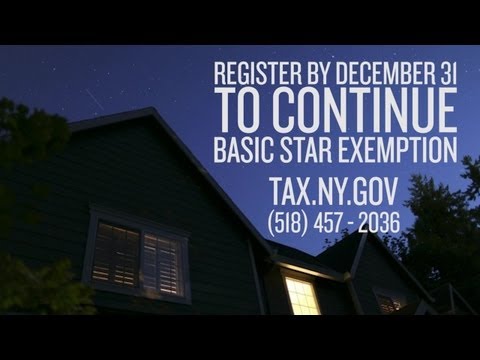

STAR Registration Reminder

October 16, 2013