Business Tax Cuts, Family Tax Relief, Health Care Measures Among New Laws That Take Effect January 1, 2014

Andrew J Lanza

December 20, 2013

Hundreds of thousands of small businesses and manufacturers in New York will see a reduction in their state taxes as a result of new tax cuts that take effect on January 1, 2014. In addition, tax relief for hardworking, middle class families, new health care protections, legal casino gaming, and the START-UP NY economic development program are among the new state laws that take effect on New Year’s Day.

“The new laws are the result of the efforts this year by Senate Republicans to cut taxes, create jobs, and provide much-needed tax relief to hardworking taxpayers,” Senator Andrew J. Lanza said. “Looking ahead to 2014, our priority will be broad-based tax relief and regulatory reform. We will be focused on tax cuts that will enable businesses to create new jobs, and provide brighter opportunities, especially for young people who want to stay in New York to live, work and raise a family. To accomplish that important goal we must reduce taxes to make New York more affordable for families and more competitive for businesses.”

Small Business Income Tax Reduction – Starting next year, hundreds of thousands of small businesses that pay under the state’s personal income tax will see a $35 million tax reduction this year. This is the first year of a three-year tax cut phase-in. Over the next three years, this tax cut will save small businesses $140 million that they can use to reinvest in their businesses, to grow and create new jobs.

Tax Relief for Manufacturers – Beginning January 1st, the state’s corporate tax on manufacturers will be reduced by almost 10 percent, saving about 13,000 manufacturing companies $30 million in 2014, and a cumulative, three-year total of $120 million by 2017-18 when the tax reduction is fully phased-in. This change will reduce costs for manufacturers and enable them to be more competitive.

Both the small business and manufacturer’s tax reductions were part of the Senate Republicans’ Blueprint for Jobs program and were included in the 2013-14 state budget.

Family Tax Relief -- Another Senate Republican tax relief initiative that starts next year is the Family Tax Relief program which will provide middle class families with a total of $375 million in tax relief in 2014, and more than a billion dollars total by 2017. Over the next three years, each New York family with at least one dependent child and a household income between $40,000 and $300,000 will receive $350 in direct tax relief.

START-UP NY Economic Development Program – The START-UP NY program begins on January 1st – this program will create tax-free areas around the state’s colleges and universities. Tax-free areas will encompass vacant land or space on the campus of SUNY schools and community colleges. Under the program, businesses will be exempt from virtually all taxes for 10 years, including corporate and personal income taxes, sales, use and property taxes. Businesses will not be eligible if they compete with existing businesses in the community that are not within the tax-free area. (Chapter 68, S5903, Senator Libous)

Minimum Wage Increase and Reimbursement Tax Credit – As of January 1, 2014, the state’s minimum wage will increase from $7.25 an hour to $8 an hour. The increase is coupled with a new Minimum Wage Reimbursement Tax Credit to help offset some of the increased wage costs for businesses.

Legalized Casino Gaming – In November, voters approved a constitutional amendment enacting the Upstate New York Gaming Economic Development Act of 2013 (Chapter 174 S5883 Senator Bonacic). The new law legalized casino gaming in New York as of January 1st and allows for the establishment of four destination gaming resorts.

Hannah’s Law -- This new law (Chapter 388, S2287A Senator Ball) will ensure adequate insurance coverage for patients living with conditions such as Eosinophilic esophagitis - a life-threatening illness that makes it impossible to eat most foods. Prior to this law, some insurance companies only covered the cost of administering nourishment via feeding tubes, even if oral feeding was an option for the patient. This bill requires coverage for administering food through feeding tubes or oral feeding.

Hepatitis C Screening – Beginning on January 1, a new law (Chapter 425, S2750A Senator Hannon) will require individuals born between 1945 and 1965 to be offered a hepatitis C screening test when receiving health services from hospital inpatient care or outpatient care. There are an estimated 3.2 million Americans infected with hepatitis C and 75 percent are people born between 1945 and 1965.

####

Share this Article or Press Release

Newsroom

Go to Newsroom

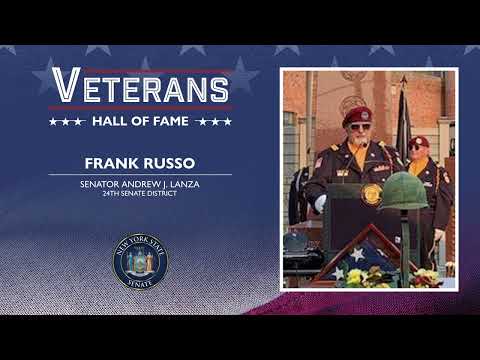

Senator Lanza 2023 Veteran Hall of Fame

November 10, 2023

Home Energy Assistance Program (HEAP)

November 2, 2023