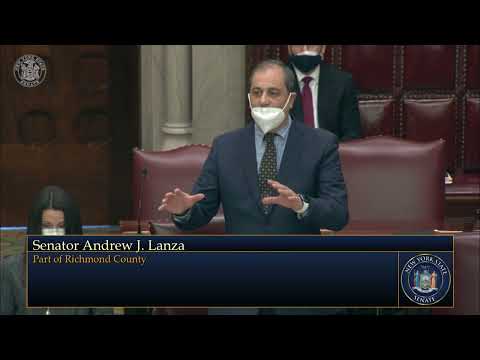

Senate Cities Committee Reports Property Tax Relief Bill to Help Homeowners Impacted by Hurricane Sandy

Andrew J Lanza

March 21, 2013

The New York State Senate Standing Committee on Cities, Chaired by Senator Andrew Lanza (R-Staten Island), has reported legislation to help homeowners in New York City recover from Hurricane Sandy. The bill (S.3702) sponsored by Senators Andrew Lanza and Martin Golden provides real property tax relief to New York City residents whose homes were severely damaged by Superstorm Sandy.

“Senator Golden, Councilman Oddo and I are committed to working with the victims of Hurricane Sandy and Government officials at all levels to provide whatever relief we can on this long road to recovery,” said Senator Andrew Lanza. “This rebate will get cash directly into the hands of City homeowners who suffered severe damage from Hurricane Sandy by ensuring property tax payments more accurately reflect properties’ post-storm values. This bill will provide tangible relief to homeowners faced with considerable financial burdens and uncertainty while rebuilding and returning to their homes.”

"We have a responsibility to help those who were hit hardest by Hurricane Sandy, and this bill provides some much needed relief," stated Senator Martin J. Golden (R-C-I). “Residents who suffered serious damage have seen a significant decrease in property value and should have that reflected in their property taxes. I call on my colleagues to pass this bill as soon as possible so that we can help those in most need."

"The push for property tax relief for folks impacted by Sandy started that morning two days after the storm hit when Senator Lanza and I stood on Fr. Capodanno and Slater and had an individual devastated by Sandy rattle off the various challenges before him, including the exorbitant property tax bill he was facing. True to his word, Senator Lanza is delivering on the relief we promised that Staten Islander and many others hurt by this storm. We need to help folks in every way possible and this includes some much need property tax relief."

Under current law, property taxes for the current fiscal year (Fiscal Year 2013) reflect assessments made in May 2012, and the tax must be based on the condition of the property on that date. Hurricane Sandy demolished or caused severe damage to hundreds of homes in the city. This bill would provide a reimbursement for a portion of the taxes paid this fiscal year to better reflect post-Sandy home values. If enacted, more than 900 properties would be eligible, with an average rebate of about $800.

#####

Share this Article or Press Release

Newsroom

Go to NewsroomSenator Lanza Announces Italian American Scholarship for 2022

February 9, 2022

Senator Lanza Debates Redistricting Legislation

February 8, 2022

NY Republican Leaders: No More Victims

January 27, 2022