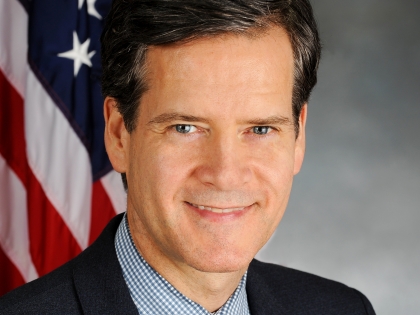

Senator Hoylman Urges State to Extend Registration Deadline for Star Property Tax Exemption

December 11, 2013

New York, NY— Alarmed by reports of low Basic STAR registration rates by New York City homeowners, New York State Senator Brad Hoylman sent a letter to New York State Department of Taxation and Finance Commissioner Thomas Mattox on Wednesday urging him to extend the December 31, 2013 registration deadline and to continue outreach efforts to ensure all eligible homeowners – including thousands of co-op and condo owners in Senator Hoylman’s district – are registered. The 2013-2014 state budget grants Commissioner Mattox the authority to set the final deadline for registration, so long as it is no later than April 1, 2014.

The New York State Department of Taxation and Finance reported that as of December 9 only 60 percent of New York City’s eligible homeowners had registered for Basic STAR, compared to at least 70 percent and often more in every other county throughout the state. According to a report by the New York City Independent Budget Office, there are still 250,000 NYC households potentially eligible for relief that have not yet registered and are at risk of being denied up to $75 million dollars in total rebates by the state.

Most New York State homeowners with household incomes under $500,000 are eligible for a Basic STAR property tax exemption on their primary residence. This year, households that have previously received the exemption must register with the New York State Department of Taxation and Finance in order to continue to receive the exemption due to a new initiative to protect New Yorkers against inappropriate or fraudulent exemptions.

Senator Hoylman (D, WFP – Manhattan) said: “I am deeply concerned by the recent report that the citywide STARregistration rate is lagging far behind the statewide rate, and many eligible New Yorkers, including the thousands of co-op and condo owners in my district, risk missing out on up to $75 million in property tax relief to which they are entitled. The state should not deny taxpayers their rebates due to a technicality. I urge Commissioner Mattox to exercise his authority to extend the deadline. Such action will allow outreach efforts to continue and ensure that as many eligible households as possible receive the tax exemption they deserve.”

You can read the full copy of the letter from Senator Hoylman here:

December 11, 2013

Thomas H. Mattox, Commissioner

New York State Department of Taxation & Finance

State Campus, Building 9

Albany, NY 12227

Dear Commissioner Mattox:

As the December 31, 2013 registration deadline for recipients of the Basic STAR property tax exemption quickly approaches, I am concerned by reports from the New York City Independent Budget Office that an estimated 250,000 currently enrolled city households have yet to register.

The current citywide registration rate is lagging far behind the statewide rate, and many eligible New Yorkers are facing the risk of missing out on millions of dollars of property tax relief to which they are entitled.

The 2013-2014 state budget grants you the authority to set the date – or dates – by which homeowners receiving the Basic STAR exemption must register in order to continue the exemption in 2014 and subsequent years, so long as the final deadline is no later than April 1, 2014. I strongly urge you to exercise that authority and extend the deadline, allowing outreach efforts to continue and ensuring that as many eligible households as possible are able to register.

Thank you for your consideration.

Sincerely,

Brad Hoylman

State Senator

27th District

Share this Article or Press Release

Newsroom

Go to Newsroom

Responding to a Citywide Rezoning Proposal

April 1, 2015

Enforcing “6 in 60” Law to Address Problem Bars

April 1, 2015