Senator Martins' Plan to Create Stability For Pension Rates Reaches Governor's Executive Budget

Jack M. Martins

January 25, 2013

-

ISSUE:

- Local Government

-

COMMITTEE:

- Local Government

As a former mayor of village, a member of the Governor’s Mandate Relief Council and chairman of the Senate Standing Committee on Local Governments, Senator Jack M. Martins is all too familiar with the challenges facing local governments, the greatest of which are skyrocketing pension rates.

“It’s the number one concern of local officials who must meet these enormous obligations while also complying with our new tax cap,” Senator Martins stated this past summer while attending Mandate Relief Council meetings, where he listened to testimony of numerous officials from local government and school districts. “It’s the way the system is set up – requiring ever increasing contributions precisely when the economy is at its worst and municipalities are least able to pay.”

Pension contributions by state, local governments and schools shot up from $368 million to $6.6 billion since 2001, a reality that could no longer be ignored. After meeting with several local government officials, Senator Martins came up with a proposal that would allow local governments and school districts employers to pay a consistent, flat contribution rate year after year. Governor Andrew Cuomo liked the proposal so much that he included it in his 2013-2014 Executive Budget, which he unveiled on Tuesday, as the Stable Rate Pension Contribution Option.

“As a stock-market based system, it stands to reason that in flush years, communities pay very little into it as investments climb, only to be hammered when the economy is weak. Just when those communities are suffering from smaller tax rolls and are least able to handle new costs, they’re being forced to contribute even more,” Senator Martins wrote in a column in August 2012, published on his website, discussing the plan to flatten pension contribution rates to enable to keep budget increases to a minimum and stay within the tax cap.

Senator Martins’ proposal called for employer pension contributions to be based on the actuarial value of the obligations over a 30 year period of time as opposed to the current practice of determining the employer contribution amount annually, beginning with the State fiscal year ending March 31, 2014. The proposal contained provisions for minor adjustments within a narrow corridor of two percent in either direction and for an adjustment in the long term fixed rate every ten years, using the current fixed rate as the base.

The local mayors Senator Martins discussed the proposal with all looked favorably upon it since it prevents volatility when it comes to the funding pension from year to year and take a long-term approach to funding pensions. “Local leaders and officials need stability in budgeting and the double digit increases year-to-year in pension costs have forced austerity on every level of government – village, town, county and even our schools,” Senator Martins said.

The plan would dramatically reduce pension contributions for local government and school districts in the near future, but will require higher payments later on. However, those higher payments that will be required in latter years be offset by savings from the new pension tier, Tier VI, which was enacted by the Legislature and Governor last year.

Senator Martins was pleased to see his proposal included in the Governor’s Executive Budget. “The long term fiscal contribution option within the budget will give necessary and immediate relief to local governments and municipalities and is a change long overdue,” he said.

In conjunction with the plan, the Senator also proposed an Article V amendment to the New York State Constitution for the purpose of permitting the comptroller to choose the methodology for valuing the assets, liabilities and obligations of pension funds, which do not diminish benefits.

Share this Article or Press Release

Newsroom

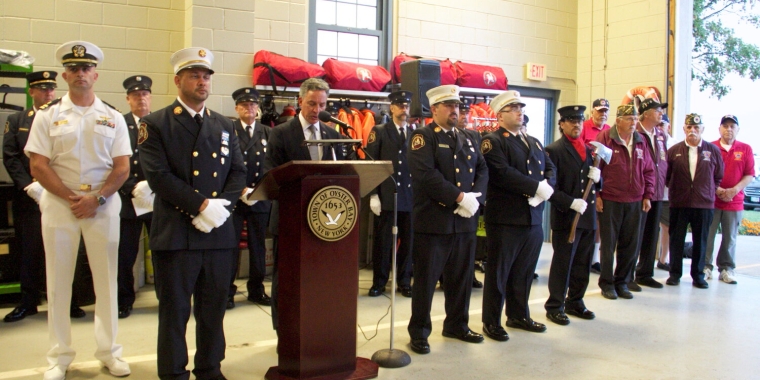

Go to NewsroomA soulful ceremony on Sept. 11 in Oyster Bay

September 15, 2023