State Senate Passes Bill to End Duplicate Vehicle Tax to Returning Members of the Military

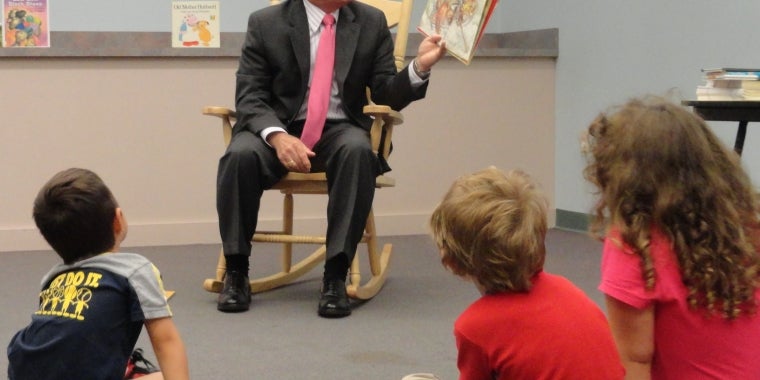

John A. DeFrancisco

June 13, 2013

-

ISSUE:

- Military

Senator John A. DeFrancisco announced that his legislation, which would end double sales taxation on vehicles of military service members who have returned to New York, passed the Senate today, June 13, 2013.

Under current law, New York residents who purchase a vehicle outside of the state are required to pay sales and use tax upon registering the vehicle. Military service members often keep their residency and driver’s license in their home state while serving out of state because of their intention to someday return. Unfortunately, in keeping residency in New York, service members upon return are subject to paying New York’s sales and use tax on a vehicle they purchased while stationed outside the state. This means that a newly discharged veteran is faced with paying these taxes twice, regardless of whether or not he or she can prove that the taxes were paid.

“The men and women who protect our country make tremendous sacrifices when they serve, and when they return to civilian life they face many challenges. We have a responsibility to show them our gratitude by making their homecoming as easy as possible,” said Senator John A. DeFrancisco, who is a U.S. Air Force Veteran. “We should provide some small benefit for the selfless service and the sacrifice of the families of returning service members.”

The bill has been sent to the Assembly and is awaiting approval by that body.

Share this Article or Press Release

Newsroom

Go to Newsroom