Senator Flanagan Calls On Governor Cuomo To Remove Utility Tax Surcharge Extension From Proposed Budget

John J. Flanagan

February 10, 2013

-

ISSUE:

- Energy

Senator John Flanagan (2nd Senate District) joined his colleagues in the Senate Republican Conference and leaders of statewide business organizations to urge Governor Andrew Cuomo to remove the proposed extension of the utility tax surcharge from his Executive Budget. The surcharge, which has increased utility bills for every ratepayer in the state, is scheduled to expire on March 31, 2014. The Governor’s proposed five-year extension would cost businesses and consumers a total of almost $3 billion.

“As our business community continues to help New York State’s economic recovery, this is the time to let people know we are truly serious about being ‘Open for Business’. It is critical that we do everything possible to help those who create the jobs our residents need and that we make it easier for them to succeed and grow. Continuing this tax would do the opposite. It is my hope that Governor Cuomo will remove it from his budget,” said Senator Flanagan.

Section 18-a of the Public Service Law authorizes an assessment on utility bills to fund the operations of energy-related agencies and authorities such as the Department of Public Service and the New York State Energy Research and Development Authority. In 2009, then-Governor David Paterson and Senate Democrats permanently increased the assessment from one-third of a percent to one percent, and added an additional one-percent surcharge, resulting in a total five-fold increase on all ratepayers.

Senator Flanagan and every Senate Republican voted against the tax surcharge in 2009. It was intended to be a temporary measure that would expire on March 31, 2014 but the 2013-14 Executive Budget proposes to extend the tax surcharge for another five years.

Senator Flanagan and his colleagues were joined at a news conference in Albany by representatives of the Business Council of New York State, the National Federation of Independent Businesses (NFIB), AARP, the Long Island Association and other groups who support an end the utility tax surcharge as scheduled.

Heather Briccetti, president and CEO of The Business Council of New York State, Inc. said: “New York's electric rates are heavily burdened by hidden taxes. A report by Public Policy Institute finds more than one-quarter of electric bills in New York are from state and local taxes. Extending the so-called ‘Section 18-a’ fee will cost all energy consumers in the state a total of $2.8 billion. We urge the governor to reconsider and use the 21-day amendments process to amend or remove Part N. In 2009, when this temporary fee was imposed, there was an explicit promise to the people of the state that this tax would not be permanent.”

Mike Durant, NFIB/NY State Director said: “Energy costs consistently rank as a top concern for small business, and assessments such as 18-a have been a significant cost driver in energy. Repealing this onerous tax has been a priority for NFIB and we are pleased to join with the Senate Republican Conference in calling for this tax extension to be removed from the Executive Budget proposal."

Kevin Law, President & CEO of the Long Island Association, said: “The 18-a energy tax adds to the cost of doing business on Long Island and makes our region and entire state less competitive, and thus its proposed extension in the budget should be eliminated.”

Beth Finkel, State Director for AARP New York, said: “AARP commends the Senate for their leadership in working to make utility bills more affordable for all New Yorkers. This is a crucial kitchen table issue, as state residents pay some of the highest utility costs in the nation, a status that takes an unduly harsh toll on the elderly and those on fixed incomes. This move, coupled with AARP's push to help consumers have a stronger voice during rate hikes, is surely needed to help New Yorkers better afford the basic necessity of their utilities."

According to figures from National Grid, the impact of the energy tax extension on a typical large business is estimated at $30,000 per year. The added cost on a typical small business would be about $540 per year and average household utility bills would increase by $55 per year. The proposed extension would cost energy ratepayers $509 million each year for five years with the total impact of the extension costing $2.8 billion, with most of the burden falling on small and large businesses, particularly manufacturers that use large amounts of energy.

Share this Article or Press Release

Newsroom

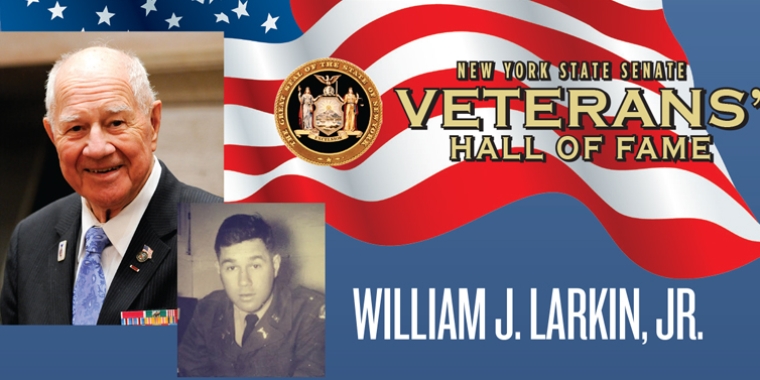

Go to NewsroomWilliam J. Larkin, Jr.

May 15, 2017