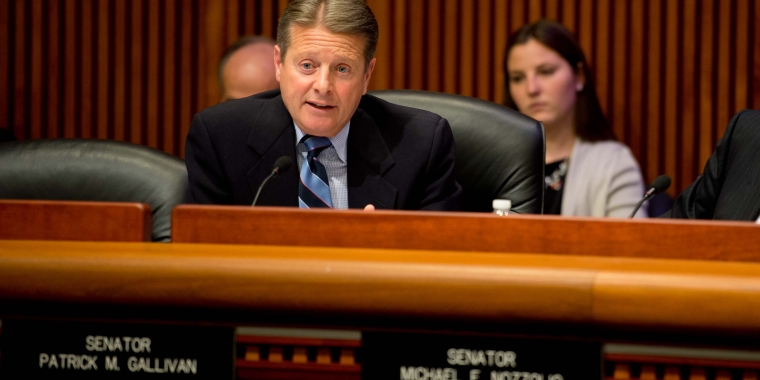

Senator Gallivan Says Upstate Film Tax Credit Will Be Included in Final Enacted State Budget

Patrick M. Gallivan

March 26, 2013

Measure Seen As Potential Boost To Upstate Economy

New York State Senator Patrick M. Gallivan (R-C-I, Elma) announced today that after weeks of negotiating, the final enacted state budget will include a provision to boost the film production industry in upstate New York.

Currently, New York State provides a tax incentive for up to 30 percent of certain production costs, but Gallivan has long argued that upstate and its unique cities need something more to attract significant studio interest.

“It’s all about costs, and one of the most prohibitive costs for film productions is labor. In New York State, most of the high-skilled labor associated with film production in based in New York City. The further away from New York City a production takes place, the more expensive it is to film. A universally applied tax credit doesn’t necessarily do much for Upstate,” Gallivan said. “This reform will really level the playing field so Buffalo, Rochester, Syracuse and other upstate communities can attract bigger productions and the inherent jobs and economic benefit that come with them.”

The new tax credit creates a two-tiered system so that an additional 10 percent credit can be applied to the amount of wages or salaries paid to most individuals directly employed by a film production in the specified geographic area. This brings the total available credit in upstate counties to 40 percent without altering the total cost of the program for taxpayers.

“This is a very useful tool that will help upstate film commissions attract more production spending. It’s a direct response to people asking "why does more than $20 million dollars in production spending drive across state lines every year?” and "why did Draft Day choose Cleveland instead of Buffalo?,” said Nora Brown, Executive Director of the Rochester and Finger Lakes Film and Video Office.

“Upstate and Western New York miss out on some film opportunities because the current incentive structure doesn’t allow us to compete with neighboring states,” said Tim Clark, Commissioner of the Buffalo Niagara Film Commission. “This new tiered film tax credit program rectifies this inequity and will really put our region on the map when studios are evaluating shoot locations.”

For the purposes of this legislation, upstate counties have been identified as the following: Allegany, Broome, Cattaraugus, Cayuga, Chautauqua, Chemung, Chenango, Clinton, Cortland, Delaware, Erie, Essex, Franklin, Fulton, Genesee, Hamilton, Herkimer, Jefferson, Lewis, Livingston, Madison, Monroe, Montgomery, Niagara, Oneida, Onondaga, Ontario, Orleans, Oswego, Otsego, Schoharie, Schuyler, Seneca, St. Lawrence, Steuben, Tioga, Tompkins, Wayne, Wyoming, or Yates.

A final state budget is expected to be passed before the end of the week. The new film production tax credit is modeled after legislation (S.498) authored by Senator Gallivan.

###

Senator Patrick M. Gallivan represents all or parts of Erie, Wyoming, Livingston and Monroe Counties in the New York State Senate.

Share this Article or Press Release

Newsroom

Go to NewsroomThe State of The State Depends on Affordability and Public Safety

January 22, 2025

Senator Gallivan to Serve on Multiple Committees

January 22, 2025