What You Should Know

Ruben Diaz

May 28, 2013

-

ISSUE:

- Finance

WHAT YOU SHOULD KNOW

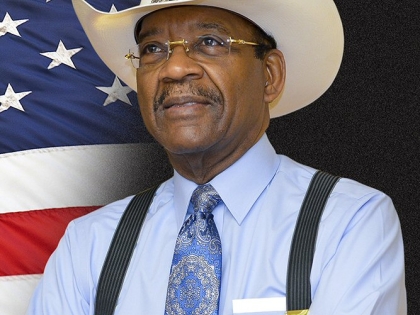

By Senator Rev. Rubén Díaz

32nd Senatorial District, Bronx County, New York

Tel. 718-991-3161

MY HUMBLE SUGGESTION FOR GOVERNOR ANDREW CUOMO

You should know that while the worst of another Great Depression seems to be over in New York State and our Governor is claiming to have balanced the budget on time for three consecutive years, nonetheless, New York continues to face difficult times and ways of finding revenue to fill its commitments.

To balance the Budget, drastic spending cuts have been made in many government agencies such as the New York State Office for the Aging, The Department of Health and State & City Universities. The workforce and education of the children continue to suffer, and many non-profit community organizations have either closed their doors or suffered unsustainable cuts.

You should also know that during my ten years of service in the New York State Senate, I have and continue to present, advice and introduce pieces of legislation to help New York State find additional resources without having to hurt the poor and needy.

The problem with my solutions and recommendations is that they will protect the poor and hurt the pocket of the wealthy and powerful, and for some people in power; it is much easier to hit the poor and not the wealthy.

You should know that this is not the first time that I have written about this, but because the Legislative Session is about to end and no one seems to care, I just want to remind you, my dear reader, of my commitment and struggle to find solutions and alleviate the burden that every year is put on the shoulders of the poor and needy of our State.

You should know that there are three pieces of legislation that I have introduced in the Senate, some of which are being introduced in the Assembly by Assemblymen Marcos Crespo, Jeff Dinowitz and Brian Kavanagh.

My “Dead Peasants” or “Janitors” Insurance Senate Bill 5388 and Assembly Bill 3896 introduced by Assemblyman Crespo, deals with abuse or injustices committed by some powerful companies toward their employees and their families.

Despite the current bleak economic picture, corporations are reaping huge financial benefits from life insurance policies they take out on their employees and/or retirees. Corporate-owned life insurance, better known as “Dead Peasants” or “Janitors” insurance, is a life insurance policy that is taken out on low-level employees, often without the knowledge or consent of the employee, and whose families are not named as beneficiaries when the employee or retiree dies.

When the employee or retiree dies, these tax free benefits are collected by the employer. Furthermore, it is believed that companies are frequently using these policies to pay for retirement benefits and other perks for their top executives. Companies that supposedly engage in the practice of purchasing these policies include Wal-Mart, Dow Chemical, Proctor & Gamble and Walt Disney.

One tragic example of this practice is that of a 48 year-old assistant manager at Wal-Mart who died of a massive heart attack. The man’s widow became the lead plaintiff in a class action suit after she learned that Wal-Mart collected $300,000 from a life insurance policy it owned on him.

My bill would impose a 50% tax on all benefits received by companies in New York State who take out life insurance policies on their employees or retirees.

Secondly, you should know that my Senate Bill S5150, introduced in the Assembly as A4066 by Assemblyman Marcos Crespo, and A157 by Assemblyman Brian Kavanagh, deal with taxes collected when purchases are made with a credit card.

A major source of failure to comply with the New York State sales taxes being remitted to the State from credit card companies who collect such taxes from their customers and instead of sending those taxes to New York State Commissioner of Taxation, the credit card companies send the taxes back to the merchant where the purchase was made.

The current system relies solely on the thousands of vendors to voluntarily remit such sales taxes to the state. It is believed that the state loses more than $800 million dollars every year on these taxes.

My legislation will force the companies to send those taxes directly to the state and not back to the vendors.

New York State cannot possibly audit every vendor and the vendors know this. However, the processors which are paid by the vendors to deal with the issuers of credit and debit cards, and who actually get the monies from the credit card issuers, are far less numerous. They know the true sales and actually get money from the credit card companies which include the sales taxes. It is more efficient to have these processors remit the sales taxes directly to New York State instead of sending the taxes back to the vendors and then relying upon the vendors to timely and accurately submit the sales taxes.

Finally, another piece of legislation that I have introduced in the Senate is S1386 which Assemblymen Marcos Crespo and Jeff Dinowitz are carrying in the Assembly as bill A4003 and bill A308.

You should know that some of the biggest money-making industries in the nation are pharmaceutical companies. The same prescription drugs that we purchase in the state of New York at sky-high prices are sold in Canada at minimum cost. Buying prescription drugs from Canada will save the state close to $1 billion dollars annually.

My legislation is based on a program that has operated successfully in Schenectady County since 2005. Since then, the County has realized savings of over $17 million dollars. Additionally, County prescription drug costs have increased less than 8.9% since the program’s inception. This figure compares favorably with the average of U.S prescriptions drug programs which have seen prices escalate by more than 12% each year, or 76.2% over five years. Over 90% of Schenectady County’s employees represented by two unions, CSEA and 1199, now participate in the program.

Since prescription drug costs are among New York State’s highest expenditures, one way the State can accomplish this goal is by creating the New York State Prescription Medication Cost Containment Program, which would be voluntary, for participants in the Elderly Pharmaceutical Insurance Program (EPIC) and for New York State civil service employees and retirees.

My advice to New York State Governor Andrew Cuomo is that the State must be more creative in its approach to raising revenue and controlling expenses, without relying on the usual methods of raising taxes and cutting - or in some cases eliminating programs that hurt the poor and needy and balance the Budget on their backs.

Governor Cuomo should take a really good look at my three pieces of legislation. If he feels that they are good for the State, he doesn’t even have to give me credit for them - he can take them and make them his top priority and push for them as he has done for same sex marriage, abortions, marijuana and election reform.

This is Senator Rev. Rubén Díaz and this is what you should know.

Share this Article or Press Release

Newsroom

Go to NewsroomWhat You Should Know

April 2, 2012

What You Should Know

March 29, 2012

What You Should Know

March 28, 2012

What You Shoul Know

March 28, 2012