Senator O'Brien reminds homeowners to reapply for STAR property tax exemption

Ted O'Brien

August 30, 2013

ROCHESTER, N.Y. -- Senator Ted O’Brien today reminded New Yorkers who currently receive the basic STAR exemption they must reapply before December 31 to continue receiving the exemption in 2014 and future years.

“The STAR exemption is one of the best tools we currently have to help protect New Yorkers from the crushing burden of property taxes,” Senator O’Brien said. “The program was being strained by inappropriate and fraudulent uses, and this reapplication process will help ensure that this program is preserved for the hundreds of thousands who rely on it for tax relief.”

The exemption is for owner-occupied primary residences with a family income less than $500,000, and exempts the first $30,000 of the home’s value from school taxes.

Homeowners can register at the Department of Taxation and Finance’s website by visiting http://www.tax.ny.gov/pit/property/star13/ and clicking “Register Online,” or by calling the department at (518) 457-2036. Registration is open now.

The process requires a unique ID code that can be looked up via the same website and phone number. The code can also be found in a letter that the department is mailing to all eligible homeowners. In the western region of the state, including Monroe and Ontario counties, those letters are being sent between August 26 and August 30. All such letters should be received by early October.

More STAR Exemption Facts:

- Resident homeowners who currently receive the Basic STAR exemption must re-register before December 31, 2013

- Homeowners do not need to re-register every year

- Based on the information provided in the registration process, the state Tax Department will confirm homeowners’ eligibility in future years

- Senior citizens receiving the Enhanced STAR exemption are not affected by the new registration requirement. However, in order to receive Enhanced STAR, seniors must continue to:

- Apply annually, or

- Participate in the Income Verification Program.

- Resident homeowners applying for STAR for the first time are not affected by this year’s registration procedure. First-time applicants must continue to use Form RP-425, Application for School Tax Relief (STAR) Exemption, and file the application with their local assessors.

“High property taxes have a serious and very negative impact on the economic well-being of Rochester and the Finger Lakes region,” Senator O’Brien said. “Preserving the STAR and Enhanced STAR exemptions is important, but I am also committed to finding new ways to reduce the incredible burden property taxes are placing on families throughout the state.”

For more information about the STAR Exemption program, please visit: http://www.tax.ny.gov/pit/property/star/apply.htm

-30-

Senator O’Brien represents the 55th district in the Senate, which is made up of the eastern half of Monroe County and the western half of Ontario County, including much of the city of Rochester.

Media contact:

Thomas J. Morrisey

Communications Director

office: (585) 218-0034

e-mail: tjmorris@nysenate.gov

Share this Article or Press Release

Newsroom

Go to NewsroomA visit from Miss New York

January 29, 2013

O'Brien receives committee assignments

January 29, 2013

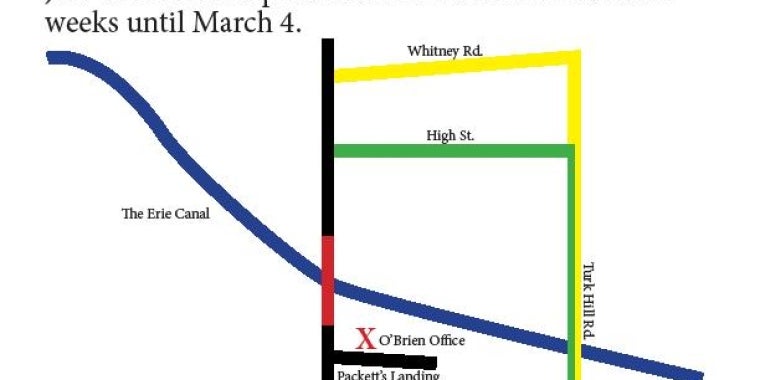

Bridge closing will affect access to District Office

January 18, 2013