O'Mara, colleagues to Cuomo: You said no new taxes, so pull the plug on this proposal

Thomas F. O'Mara

February 5, 2013

-

ISSUE:

- Energy

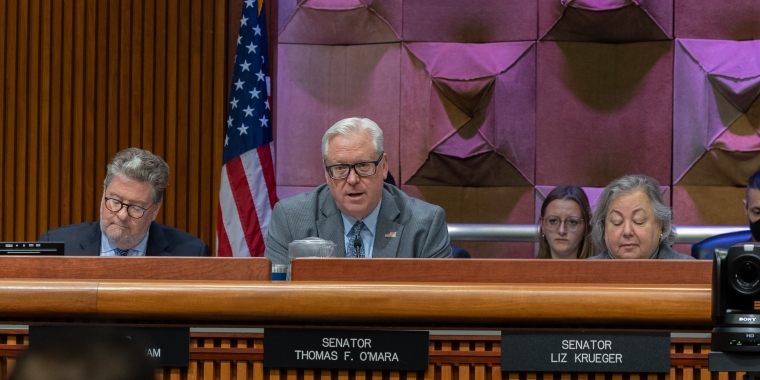

Albany, N.Y., February 5—State Senator Tom O’Mara (R-C, Big Flats), a member of the Senate Energy and Telecommunications Committee, is joining his Senate Republican colleagues in opposition to Governor Andrew Cuomo’s proposal for a five-year extension of a “staggering” energy tax first imposed on New Yorkers in 2009.

“This higher utility tax was one of the worst products of one-party control in New York State government in 2009. I voted against the increased assessment when it was first imposed on businesses and consumers four years ago. It was a bad move then, it’s worse now when New Yorkers find it even harder to make ends meet and the monthly utility bill continues to be sky high,” said O’Mara, who’s serving on the Senate’s budget subcommittee on economic development and taxes. “Governor Cuomo said ‘no new taxes’ in this budget and he should mean it. He should pull the plug on this proposal. Higher taxes like this one are tough on consumers and make it harder and harder for New York’s businesses, farmers and manufacturers to stay competitive.”

[Watch Senator O'Mara's comments at the Capitol today]

O’Mara and his colleagues are urging the governor, during the current 21-day amendment period when Cuomo can unilaterally make changes to his proposed 2013-14 state budget, to remove the proposal for a five-year extension of a nearly 600-percent hike in the Temporary State Energy and Utility Service Conservation Assessment, commonly known as the 18-a assessment, that New York consumers, businesses, farmers, school districts, not-for-profits and others have paid on their utility bills since 2009. The higher assessment, from 0.33 percent to two-percent, was first imposed when both houses of the Legislature were under Democratic control and signed into law by then-Governor David Paterson, also a Democrat. Every Senate Republican voted against it.

Senate Republicans were joined at a news conference today by representatives of the Business Council of New York State, the National Federation of Independent Businesses (NFIB), the Manufacturers Association of Central New York (MACNY), the New York Farm Bureau and AARP. Other businesses groups, including Unshackle Upstate, also support the Senate’s call to end the utility tax surcharge as scheduled.

The higher assessment is scheduled to be rolled back to one percent and fully phased out in 2014. O’Mara said that the 2009 tax hike has already taken $1.2 billion out of the economy and if Cuomo’s current proposal becomes law, it will mean another nearly $3-billion economic hit over the next several years.

Karyn Burns, Vice President for Communications & Government Relations of MACNY, The Manufacturers Association of Central New York, said, "As we began our path together in achieving fiscal stability here in New York State three years ago, Governor Cuomo remained committed to not raising taxes on businesses and residents, and in turn the State's manufacturing and business community worked to keep business going, their doors open, products manufactured and job retained and added. An extension of the 18-a tax would be a huge step back for these hard working businesses. To continue this tax will most certainly compromise the business community's ability to do everything they need to on this continued path towards economic recovery."

New York Farm Bureau Public Policy Director Julie Suarez said, “At a time when the prices of feed and fuel are sky high for our members, it is imperative for the state to allow the Article 18-a assessment step down to go forward to help contain rising production costs. Profit margins are thin at best for many of New York’s family farms, and keeping the 2% “tax” in place is not the business friendly approach that will help New York’s farms be more competitive.”

Beth Finkel, State Director for AARP New York, said: “This is a crucial kitchen table issue, as state residents pay some of the highest utility costs in the nation, a status that takes an unduly harsh toll on the elderly and those on fixed incomes."

Share this Article or Press Release

Newsroom

Go to Newsroom