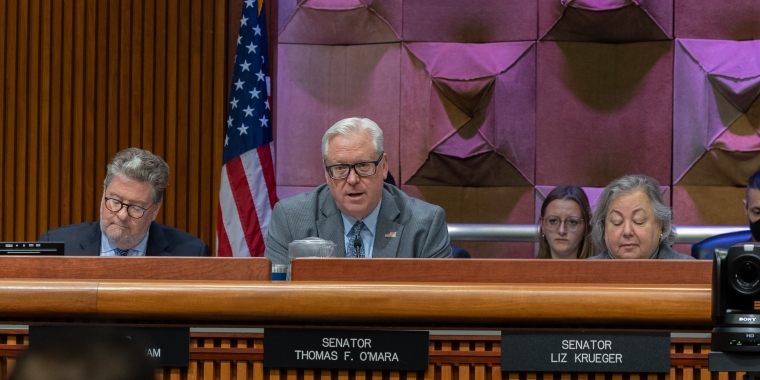

Senate GOP's 'Blueprint for Jobs' includes O'Mara's call for manufacturing tax cut, utility tax relief and Hire-a-Vet tax credit

Thomas F. O'Mara

March 8, 2013

-

ISSUE:

- Economic Development

Albany, N.Y., March 8—A comprehensive state Senate Republican plan to jump-start the state economy and create private-sector jobs includes a proposal introduced earlier this year by State Senator Tom O’Mara (R-C, Big Flats) to phase-out the corporate franchise tax for manufacturers across the Southern Tier and Finger Lakes regions, and statewide.

The plan also includes proposals for a utility tax cut and the creation of a Hire-A-Vet tax credit which O'Mara has pushed over the past several weeks.

“Turning around the upstate economy calls for bold action. Manufacturing has always been the economic engine of many upstate communities, and it remains our best hope for any long-term revitalization. Government can help lead that effort by starting with this pro-job, pro-private-sector, pro-manufacturing tax cut. We can't just settle for no new taxes. The goal needs to be tax cuts,” said O’Mara, who earlier this year introduced legislation (S.3562/A.3342), which has strong bipartisan support in the Legislature, to phase-out the franchise tax.

The Senate GOP “Blueprint for Jobs,” which O’Mara co-sponsors, calls for eliminating the tax over the next three years, saving manufacturers large and small $445 million, a move that O’Mara and manufacturing leaders believe will help create upwards of 3,000 good-paying, private-sector jobs over the next few years, encourage existing manufacturers to expand and invest in their New York facilities, and make the state a more attractive place for other manufacturers to locate their operations here in the future.

New York’s manufacturers currently pay taxes that are higher than virtually anywhere else in the industrialized world.

“We have to do better. We have to send an even stronger message that New York’s serious about business. We need newer and bolder steps to keep building on the efforts of the past two years to turn around the upstate economy, strengthen manufacturing, create good jobs and revitalize upstate regions like our own,” O’Mara said, adding that a January 2013 report from the Tax Foundation gave New York the dubious distinction of having the worst business tax climate in the nation. “Our ‘Blueprint for Jobs’ would produce a business climate that invites private-sector job growth, welcomes businesses and industries, and helps provide long-term economic security for workers and their families.”

The Senate plan also includes the following priorities that O’Mara has targeted over the past several weeks:

-- a Hire-a-Vet tax credit to businesses that hire veterans returning home from military service. Specifically the plan would create a credit equal to up to 10 percent of wages paid and increasing to 15 percent of wages if the veteran is disabled. It would also help small businesses owned by service disabled veterans by increasing their access to government contracts.

“It’s a tough economy all around, but the impact has been especially hard on veterans returning home during this recession to a weak private-sector economy. It’s hard to find work and that’s particularly true for wounded veterans,” said O’Mara. “America’s servicemen and servicewomen make enormous sacrifices. This tax credit is one additional way to recognize their service and try to encourage economic opportunities and jobs for returning veterans.”; and

- a renewal of the repeated call by O’Mara and his colleagues over the past several weeks to eliminate Governor Andrew Cuomo’s proposal for a five-year extension of a higher utility tax first imposed on New Yorkers in 2009, the so-called 18-a assessment that hits farmers, manufacturers and senior citizens facing high energy costs especially hard.

Overall, the “Blueprint for Jobs” plan, which the Senate would like to see approved as part of the final 2013-14 state budget currently being negotiated by the governor and Legislature, would also provide:

> tax relief for one million small businesses;

> sweeping reforms to cut red tape and regulations impacting businesses;

> job training and retraining initiatives;

> investment funding to help launch start-ups; and

> incentives to revitalize downtowns and Main Streets.

“Blueprint for Jobs” is being embraced by business leaders statewide.

Manufacturer’s Association of Central New York (MACNY) President Randy Wolken said: "This past week, manufacturers from across the State convened in Albany to let legislators know that in order to strengthen our critical sector and the economic strength we provide, a better business climate is needed, with lower costs of doing business. Senate Republicans clearly heard this message. With their proposal of a repeal to the 18-a tax, in addition to elimination of the corporate franchise tax for manufactures, they are clearly proposing a budget version that is business friendly, helps create a better business climate, and creates a platform that will enable manufacturers and businesses help get our State back on track."

Heather Briccetti, President and CEO of The Business Council of New York State, Inc. said: "The budget plan put forth today by the Senate Republicans is clearly designed to control state spending and create good-paying jobs. If we are to improve the state's economy and create more private-sector jobs we need to reduce the cost of doing business in New York through tax cuts, fiscal restraint, regulatory reform, and targeted investments in our workforce. ”

Brian Sampson, Executive Director of Unshackle Upstate said: “Unshackle Upstate has long advocated for lowering the tax burden in order to help our Upstate manufacturers and small business owners. This proposal advances sensible tax cuts, the elimination of the surcharge on the 18-a energy tax, the repeal of the Wage Theft Prevention Act’s annual notification requirement and the implementation of a state spending cap. We support these measures as they will help boost job growth and strengthen our economy. ”

Mike Durant, State Director of the National Federation of Independent Business (NFIB) said: “This job creation plan injects significant fiscal relief for small business and is a commitment to drastically changing the economic trajectory of New York. It incorporates many of the top legislative priorities for NFIB by drastically reducing taxes and providing needed regulatory reform. This is exactly what small business needs in this State.”

Read more on "Blueprint for Jobs."

Share this Article or Press Release

Newsroom

Go to Newsroom