City, State Leaders Outline Initiatives to Eliminate ‘Zombie Houses’, Hold Banks Accountable for Foreclosure Delay

Timothy M. Kennedy

August 9, 2013

-

ISSUE:

- Housing

- Foreclosure

Kennedy, Brown, Kearns, Scanlon gather at 124 McKinley Parkway to bring attention to impact of ‘zombie houses’ on city neighborhoods.

Coordinated efforts from city and state lawmakers aim to combat the growing problem of blighted, vacant homes stuck in foreclosure limbo.

Kennedy: ‘Zombie houses’ are eating up our neighborhoods and leaving eyesores and diminished property values in their wake. These out-of-town banks must be held accountable for the harm they’ve caused.

BUFFALO, N.Y. – Senator Tim Kennedy, Buffalo Mayor Byron Brown, Assemblymember Michael Kearns, City Councilmember Chris Scanlon today stood in front of a so-called “zombie house” at 124 McKinley Parkway in Buffalo to call for action in the fight to prevent vacant homes that are stuck in foreclosure limbo from blighting neighborhoods throughout Buffalo and Western New York. These “zombie houses” – or properties abandoned by their owners after banks commence foreclosure proceedings – can be found in neighborhoods throughout the region, and their negative impact grows even more severe when banks drag their feet and delay the foreclosure process for years after a property has been vacated. The lawmakers outlined coordinated city and state initiatives that they are pursuing to hold banks accountable for delaying the foreclosure process and to prevent abandoned homes from blighting the community.

“New York State needs to get tough on those banks whose recklessness caused a global financial collapse and whose ongoing negligence is blighting our neighborhoods,” said Senator Kennedy. “The road from Wall Street to Main Street is being littered with abandoned and neglected properties, and all the banks have done is drag their feet. So-called ‘zombie houses’, like 124 McKinley, are eating up otherwise pristine, well-kept neighborhoods and leaving eyesores and diminished property values in their wake. The out-of-town lending institutions blighting our community bear responsibility for this crisis and must be held accountable. Our state legislation, paired with the city’s efforts, will help do exactly that. New criminal penalties and stronger accountability measures will send a clear message to Wall Street: You made this mess; you clean it up.”

“In these tough financial times, the Great Recession has hit homeowners extremely hard. Many families now face foreclosure on their home because of the loss of jobs,” said Assemblymember Kearns. “Over 200 municipal deliberative bodies have voted in favor of bills A.88 and A.824, and more than 824 elected officials voted in favor of the bills with final certification pending from several more.”

“The secret that we’ve all known for years is finally out: South Buffalo is a great place to live. Homes are flying off the market at record prices. We will not allow these deteriorating vacant properties to destroy the community we’ve worked so hard to maintain,” said Councilmember Scanlon. “At the City level, I have been working closely with Comptroller Schroeder, who has agreed to reevaluate the City’s relationship with any banks that refuse to act as responsible neighbors. I have also recently begun a program where I personally cut the lawns of many of these vacant properties, and then proceed to bill the responsible banks on behalf of the City of Buffalo. I believe our only option is to hit the large institutions where it hurts: their wallets.”

In many neighborhoods throughout Buffalo and Western New York, banks and other lending institutions have proven to be poor neighbors – allowing properties to fall into disrepair and become blighted. Kennedy has proposed new legislation that will require banks to maintain a property if it becomes vacant after they commence a foreclosure proceeding. And if they fail to do that, the bill will allow law enforcement to charge banks and their executives with criminal penalties. Under Kennedy’s legislation, the state will be able to pursue a class B misdemeanor charge of Criminal Negligence of Vacant Property in Foreclosure Proceedings, which is punishable by a $10,000 fine or up to 6 months in prison.

At the press conference, Senator Kennedy also outlined legislation, signed into law last week, that will help expedite homeowners’ involvement in court-supervised settlement conferences where they have an opportunity to negotiate alternatives to foreclosure, such as loan modification or short sales. This new law – which Kennedy cosponsored and was commonly referred to as the “Certificate of Merit” bill – will require lending institutions to file the necessary paperwork that triggers the settlement conference, simultaneously with the filing of any foreclosure action to prevent further delays that negatively affect homeowners.

According to Attorney General Eric Schneiderman’s office, lending institutions often delay filing essential paperwork that affirms their right to foreclose the property, which results in homeowners’ foreclosure cases being delayed for months, or years. This paperwork also initiates the settlement conference process, which gives homeowners the chance to resolve their case and avoid foreclosure. This delay from the banks has created a substantial backlog – which has become widely known as the “shadow docket” – hurting homeowners and burdening the courts system. The new law aims to stop the banks from delaying the process by requiring the immediate filing of the paperwork that opens the settlement conference process for homeowners. A July 2012 report from the Office of Court Administration found that 25,000 families are trapped in this foreclosure limbo caused by the banks delay.

“This problem has distressed neighborhoods in Buffalo, Cheektowaga, Lackawanna and beyond,” Kennedy added. “Our community must stand together to protect neighborhoods from the destruction often left behind by the big banks’ blind pursuit of profits.”

Kennedy also detailed new legislation he’s pursuing to specifically address the issue of “zombie houses” and push banks to accelerate their protracted proceedings after a property has been abandoned. This proposal will allow an expedited foreclosure process after a house is abandoned and left vacant. It will ensure banks don’t delay the process, and it will protect neighborhoods by ensuring banks move more quickly to get vacant homes back into the hands of a responsible homeowner. Kennedy’s proposal will also contain strict protections to ensure homeowners are granted every opportunity possible to remain in their homes after a foreclosure proceeding is commenced.

Essentially, this proposal would create a clear legal process to determine that a vacant home has been abandoned after a bank has commenced a foreclosure proceeding. The courts would assess numerous factors –such as an extended absence of any activity from the property owner, ongoing violations of municipal housing codes, any risk the property poses to the health and safety of neighbors, a clear and constant lack of maintenance, the time that has passed since utilities were turned off, and other items – to find if a house has, in fact, been abandoned. After giving the homeowner sufficient opportunity to respond to the contrary – that they have not yet abandoned their property – banks would be compelled to expedite the process before the vacant property further diminished neighboring homes’ values and blights the community.

Assemblymember Kearns is continuing his pursuit of his bill (A.88) that calls upon banks to provide contact information to municipalities of property managers and maintenance companies, so that foreclosed properties can be repaired and maintained. He also discussed his legislation (A. 824) that requires banks to act with honesty, reasonableness and fairness from the commencement of the foreclosure process until the final disposition of the structure.

Over 200 municipalities have passed resolutions in support of Kearns’ bills. The outpouring of support underscores the problems faced by elected officials on the frontlines of the foreclosure crisis in New York State. Assemblymember Kearns said, “When so many representatives at the local level, who deal with foreclosures daily, vote in favor of new legislation, it’s time that state officials listened and changed the law so that it is responsive to this crisis.”

The city has taken a grassroots approach to address this problem and improve quality of life. South District Councilmember Chris Scanlon regularly visits vacant homes in his district to mow the lawn and take care of the yards himself. His efforts also provide a financial bump for the city, since the Department of Public Works will bill the banks for the property maintenance that Scanlon completes.

Scanlon has also worked to mobilize the community, gathering over 3,000 signatures from residents who signed on to a letter to lenders, such as CitiBank and Well Fargo, urging them to be good neighbors and maintain their vacant properties. Scanlon says this outreach has opened up new lines of communication between his office and lending institutions.

At 124 McKinley, the mortgage is currently held by Celink, a Michigan-based mortgage company, but the homeowner vacated the property years ago. This sheds light on another problem facing municipal governments across the state – mortgages trade hands as lending institutions sell them and buy others. This makes it difficult for municipal governments to track the lender responsible for the mortgage and its corresponding abandoned property.

###

Senator Timothy M. Kennedy represents the New York State Senate’s 63rd District, which is comprised of the town of Cheektowaga, the city of Lackawanna and nearly all of the city of Buffalo. More information is available at http://kennedy.nysenate.gov.

Share this Article or Press Release

Newsroom

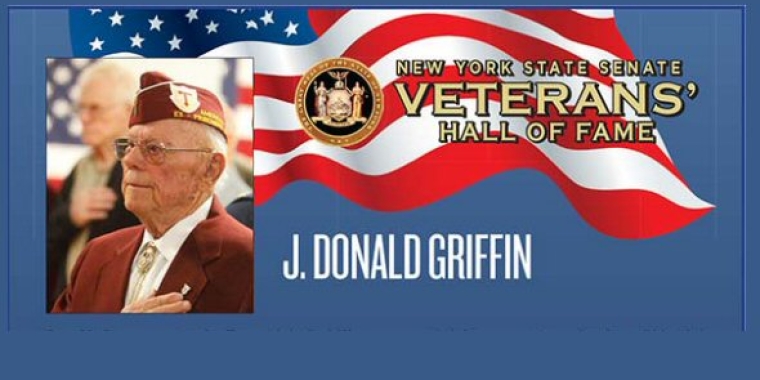

Go to NewsroomJ. Donald Griffin

May 16, 2014

Debra Liegl

May 14, 2014