A Message from Senator Stavisky Regarding Co-op and Condo Abatements

January 25, 2013

-

ISSUE:

- Housing

- Property Tax

- Seniors

Dear Friend,

Many of you have contacted me and other legislators to express your concern about the expiration of the Co-op and Condo tax abatement.

In Albany, we have been focused on resolving this issue for many months, and I am delighted to inform you that last night the Senate passed legislation, 56-7, extending the tax abatement.

This bill, (S.2320) retroactive to June 2012, will cover the co-op and condos in New York City. It provides a progressive, equitable abatement schedule which will benefit owner-occupied co-ops and condos. The legislation provides that:

- In fiscal years commencing in 2012, 2013 and 2014, dwelling units in property whose average unit assessed value is less than or equal to $50,000 shall receive a partial abatement of 25%, 26.5% and 28.1% respectively.

- In fiscal years commencing in 2012, 2013 and 2014, dwelling units in property whose average unit. assessed value is more than $50,000, but less than or equal to $55,000, shall receive a partial abatement of 22.5%, 23.8.% and 25.2% respectively.

- In fiscal years commencing in 2012, 2013 and 2014, dwelling units in property whose average unit. assessed value is more than $55,000, but less than or equal to $60,000, shall receive a partial abatement of 20.0%, 21.2% and 22.5% respectively.

- In fiscal years commencing in 2012, 2013 and 2014, dwelling units in property whose average unit assessed value is more than $60,000, shall receive a partial abatement of 17.5%.

It provide's the benefit schedule for units that received the abatement in fiscal year two thousand twelve, which are located in a property that does not contain a unit that is the primary residence of the owner of such units. The benefits are as follows:

- In fiscal years commencing in 2012, 2013 and 2014, dwelling units in property whose average unit assessed value is less than or equal to $15,000 shall receive a partial abatement of 12.5%, 6.25% and no abatement respectively.

- In fiscal years commencing in 2012, 2013 and 2014, dwelling units in property whose average unit assessed value is greater than $15,000 shall receive a partial abatement of 8.75%, 4.375% and no abatement respectively.

The bill goes to the Assembly, where under Assemblyman Ed Braunstein's knowledgeable and steadfast leadership, I am confident that it will pass.

Sincerely,

Senator Toby Ann Stavisky

Share this Article or Press Release

Newsroom

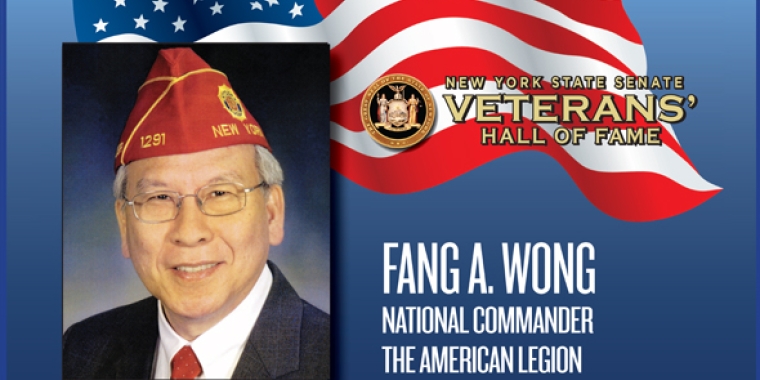

Go to NewsroomFang A.Wong

May 18, 2012

Roberta Goldenberg

June 9, 2011