Senator Lanza Urges Constituents to Use IRS Free File for Online Tax Assistance & E-Filing

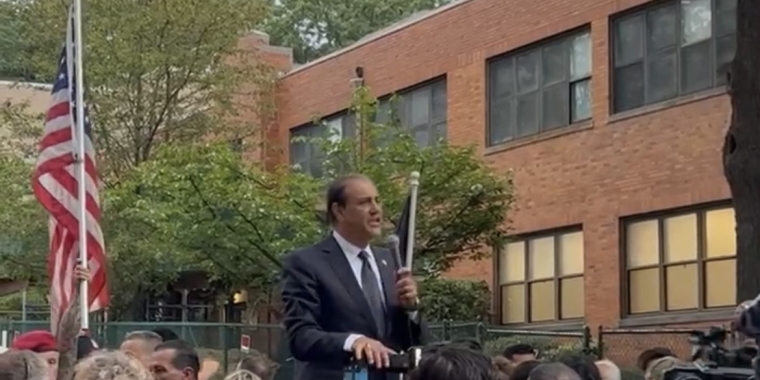

Andrew J Lanza

February 12, 2014

Taxpayers Making $58,000 or Less Can Visit www.IRS.gov/freefile to Prepare and E-File Federal Tax Returns with Free Software & Step-by-Step Help

Senator Andrew Lanza today encouraged constituents to take advantage of free tax preparation services available through the Free File program. Every taxpayer with a 2013 Adjusted Gross Income of $58,000 or less may visit www.IRS.gov/freefile to prepare, complete and e-file their federal tax returns at no cost.

Free File is made possible through a partnership between the IRS and the Free File Alliance, a coalition of industry-leading tax software companies. Since its inception in 2003, the program has offered 70 percent oftaxpayers free access to leading commercial tax preparation software from Free File Alliance member companies. Free File has already saved taxpayers an estimated $1.2 billion in filing costs.

“I encourage everyone making $58,000 or less to visit www.IRS.gov/freefile and take advantage of the free tax services available from the IRS and Free File Alliance,” said Senator Lanza. “The Free File program provides free access to tax preparation software so you can easily prepare and e-file your federal taxes online at no cost. All the calculations are done for you in just a few easy steps, and you can even get a refund in as few as 10 days.”

IRS Free File is available at www.IRS.gov/freefile, which provides a list of Free File Alliance member companies and their free tax software offerings. Users may either choose the company that fits their needs orutilize the “Help me Find Free File Software” tool. After selecting a company, users will be transferred to the company's website to prepare, complete and electronically file their federal income tax returns. The service is also available in Spanish.

Free File also offers basic federal e-filing services with no income limitations. This basic e-filing service, called Free File Fillable Forms, allows taxpayers who are familiar with tax law and need no preparation assistance to complete and file their federal income tax electronically. It is also available at www.IRS.gov/freefile.

“Free File makes tax time simple, fast and free for 70 percent of Americans,” said Tim Hugo, executive director of the Free File Alliance. “Since 2003, the Free File Alliance has partnered with the IRS to give taxpayers access to leading online tax preparation software and critical step-by-step support. This year, we invite every taxpayer making $58,000 or less to join the 40 million Americans who have already saved time and money by using Free File.”

Free File Alliance member companies have continually worked with the IRS to strengthen the Free File program, and taxpayers have consistently reported that it is user-friendly and efficient. Responding to a 2009 IRS survey, 96 percent of users said they found Free File easy to use, while 98 percent said they would recommend the program to others.

About the Free File Alliance

The Free File Alliance, a coalition of 14 industry-leading tax software companies, has partnered with the IRS since 2003 to help low and middle-income Americans prepare, complete and e-file their federal tax returns online. The Free File Alliance is committed to giving 70 percent of Americans free access to the industry’s top online tax preparation software. About 40 million returns have been filed through Free File since its inception. For more information, visit www.freefilealliance.org.

###