Senator Martins: Senate Passes Bill Simplifying Application for Senior Citizens Renewing Enhanced Star Tax Exemption

Jack M. Martins

May 6, 2014

Senator Jack M. Martins (R-7th Senate District) announced that the New York State Senate recently passed legislation that would create a shorter, simplified renewal application for senior citizens who already receive an Enhanced STAR tax exemption. Senator Martins cosponsored the legislation (S2937) with Senator Kemp Hannon (R-6th Senate District).

“Enhanced STAR provides valuable property tax savings to eligible senior citizens. Creating a simplified renewal application form will make it easier for seniors to take advantage of property tax savings to which they are entitled,” said Senator Martins.

The Enhanced STAR tax exemption provides an increased benefit for the primary residences of senior citizens (aged 65 and older) with qualifying income. This new application would relieve both seniors and tax assessors of needless paperwork and wasted time, especially in cases where the eligibility information is the same.

The legislation has been sent to the Assembly.

Share this Article or Press Release

Newsroom

Go to NewsroomEnd Jew-hatred rallies against systemic antisemitism at CUNY

September 15, 2023

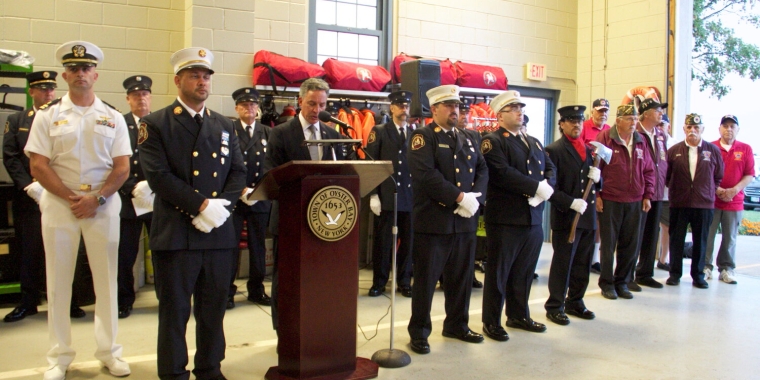

A soulful ceremony on Sept. 11 in Oyster Bay

September 15, 2023