Senator Kathy Marchione comments on 2014 State of the State Address

Kathleen A. Marchione

January 8, 2014

For Immediate Release: January 8, 2014

Contact: Josh Fitzpatrick, (518) 455-2381, fitzpatr@nysenate.gov

Cell: (518) 542-2413, joshuakevfitz@yahoo.com

Follow Senator Marchione on Twitter: @Kathymarchione, find Senator Marchione on Facebook

Video of Senator Kathy Marchione commenting on the 2014 State of the State Address is available on YouTube at: http://tinyurl.com/n6jo29y (written statement is below)

Senator Kathy Marchione: State of our State is improving but much more must be done – tax cuts for families and businesses, unshackling upstate’s economy, capping state spending, making our schools whole, banning unfunded mandates, cutting job-killing regulations – all are needed

Statement from Senator Kathleen A. Marchione (R,C-Halfmoon) regarding

Governor Cuomo’s 2014 State of the State Address:

“I am very pleased that Governor Cuomo has been reading from the policy playbook I and my Senate Republican colleagues have advanced. We need to continue our successes and do more – much more – to cut taxes for everyone to make New York more affordable and create more jobs and opportunities. We need to reform state government, make it smaller, cost less, work smarter – and work better – for the people it serves.

I support lowering the Corporate Tax rate to 6.5 percent, cutting taxes for upstate manufacturers to zero, lowering and reforming New York’s Death Tax, and providing a five percent contract set aside for disabled veteran-owned small businesses. I have a similar bill (‘OORAH: Opening Opportunities, Resources and Access for Heroes’) to help veteran-owned businesses grow and expand. All of these are welcome ideas that I’ve championed, first as a candidate, now as a Senator.

It was positive to hear the Governor indicate that regulatory reform must be a priority. As Chair of the Senate’s Administrative Regulations Review Commission, I helped lead an effort to identify thousands of job-killing rules, regulations and red tape that should be revised or eliminated. We can, and should, enact our bi-partisan regulatory reform proposals; there is no need to wait.

A property tax freeze sounds good. Without question, we need to act. New Yorkers still pay property taxes that are the nation’s highest. But, a freeze alone isn’t enough. We must address the true, underlying cost drivers of property taxes: Albany’s unfunded mandates.

Going forward, we still need to work towards enacting a State Spending Cap, responding to concerns parents, teachers and students have regarding Common Core, helping our schools – especially upstate schools – by paying down the Gap Elimination Adjustment (GEA) and providing assistance to more veteran-owned businesses so they can grow.”

-30-

Share this Article or Press Release

Newsroom

Go to NewsroomTHANKSGIVING ESSAYS AND CONTRIBUTIONS SD 43

November 24, 2015

Thank you veterans!

November 10, 2015

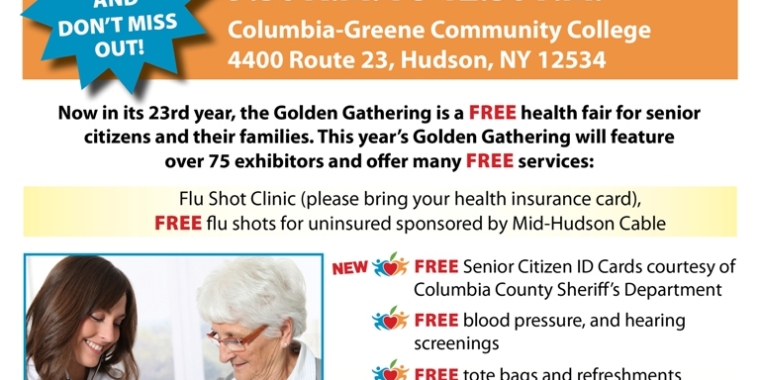

Don't miss out on FREE Health Care Services at the Golden Gathering!

October 16, 2015