Senator Kathy Marchione comments on 2014 State of the State Address

Kathleen A. Marchione

January 8, 2014

For Immediate Release: January 8, 2014

Contact: Josh Fitzpatrick, (518) 455-2381, fitzpatr@nysenate.gov

Cell: (518) 542-2413, joshuakevfitz@yahoo.com

Follow Senator Marchione on Twitter: @Kathymarchione, find Senator Marchione on Facebook

Video of Senator Kathy Marchione commenting on the 2014 State of the State Address is available on YouTube at: http://tinyurl.com/n6jo29y (written statement is below)

Senator Kathy Marchione: State of our State is improving but much more must be done – tax cuts for families and businesses, unshackling upstate’s economy, capping state spending, making our schools whole, banning unfunded mandates, cutting job-killing regulations – all are needed

Statement from Senator Kathleen A. Marchione (R,C-Halfmoon) regarding

Governor Cuomo’s 2014 State of the State Address:

“I am very pleased that Governor Cuomo has been reading from the policy playbook I and my Senate Republican colleagues have advanced. We need to continue our successes and do more – much more – to cut taxes for everyone to make New York more affordable and create more jobs and opportunities. We need to reform state government, make it smaller, cost less, work smarter – and work better – for the people it serves.

I support lowering the Corporate Tax rate to 6.5 percent, cutting taxes for upstate manufacturers to zero, lowering and reforming New York’s Death Tax, and providing a five percent contract set aside for disabled veteran-owned small businesses. I have a similar bill (‘OORAH: Opening Opportunities, Resources and Access for Heroes’) to help veteran-owned businesses grow and expand. All of these are welcome ideas that I’ve championed, first as a candidate, now as a Senator.

It was positive to hear the Governor indicate that regulatory reform must be a priority. As Chair of the Senate’s Administrative Regulations Review Commission, I helped lead an effort to identify thousands of job-killing rules, regulations and red tape that should be revised or eliminated. We can, and should, enact our bi-partisan regulatory reform proposals; there is no need to wait.

A property tax freeze sounds good. Without question, we need to act. New Yorkers still pay property taxes that are the nation’s highest. But, a freeze alone isn’t enough. We must address the true, underlying cost drivers of property taxes: Albany’s unfunded mandates.

Going forward, we still need to work towards enacting a State Spending Cap, responding to concerns parents, teachers and students have regarding Common Core, helping our schools – especially upstate schools – by paying down the Gap Elimination Adjustment (GEA) and providing assistance to more veteran-owned businesses so they can grow.”

-30-

Share this Article or Press Release

Newsroom

Go to NewsroomDelivering Health Benefits to Volunteer Firefighters

October 23, 2017

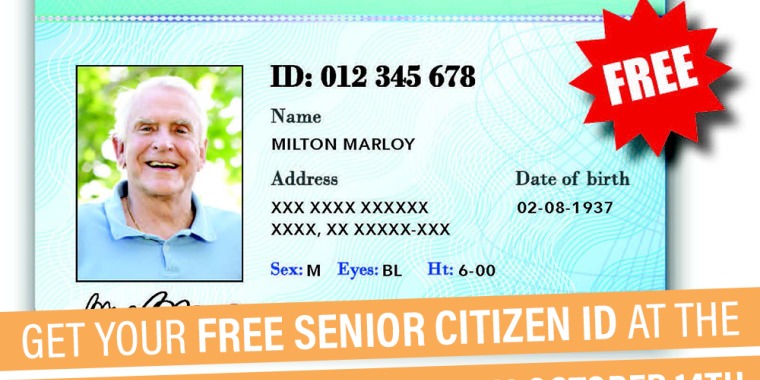

Don't miss Senator Kathy Marchione's Golden Gathering!

September 19, 2017