Senator Zeldin Protects Children from Identity Theft

Lee M. Zeldin

June 17, 2014

-

ISSUE:

- Consumer Protection

June 17, 2014

For Immediate Release

Contact: Kara Cumoletti (518) 455-3570

Senator Zeldin Protects Children from Identity Theft

ALBANY—Senator Lee Zeldin (R, C, I—Shirley), Chair of the Senate Consumer Protection Committee, announced today that his bill aimed at protecting minor children from identity theft passed in the Senate.

The bill, S. 6682-B, will create a mechanism whereby parents or guardians can place a freeze on the credit record of a minor child in order to prevent their child from becoming a victim of identity theft.

“Identity theft is a major consumer protection issue that victimizes millions of Americans each year,” said Senator Zeldin when asked about the bill’s significance. “Our children are especially vulnerable to these attacks as they can carry on undetected for years, until the child applies for student loans, other forms of credit, or even a job. As the Chair of the Senate’s Consumer Protection Committee, and as a father, I am especially proud to see this bill pass today.”

According to a 2012 survey by the Identity Theft Assistance Center and the Javelin Strategy & Research group, in families with children under 18, one in forty had at least one child whose personal information was compromised.

The Federal Trade Commission (FTC) advises parents to check their children’s credit report for suspicious activity, noting that a child's social security number can be used by identity thieves to apply for government benefits, open bank and credit card accounts, apply for a loan or utility service, or rent a place to live. Further, the FTC advises parents to take immediate action should they find that personal information is being misused. However, current law only allows a parent to freeze their child’s credit after a file in their name already exists. Typically, such a file only exists if the child has already been the victim of identity theft.

Senator Zeldin’s bill requires credit reporting agencies to allow a parent to freeze their child's credit even when no file exists, thereby averting the potential for identity theft to occur in the first place.

“This bill aims to empower parents by providing a mechanism that allows them to take proactive steps to safeguard their child’s identity,” Senator Zeldin continued. “In our data-driven world where one’s personally identifying information is critical to financial health and stability, it is imperative that parents have a way to protect their children's credit records to ensure that they can start off on sound financial footing.”

A result of extensive work with businesses and industry professionals, this important legislation strikes a balance between protecting New York consumers and creating a stable platform for affected businesses.

The bill is sponsored in the Assembly by the Chair of their Committee on Consumer Affairs and Protection, Assemblyman Jeffrey Dinowitz (D-Bronx).

-30-

Share this Article or Press Release

Newsroom

Go to Newsroom2013 Legislative Session Overview

July 29, 2013

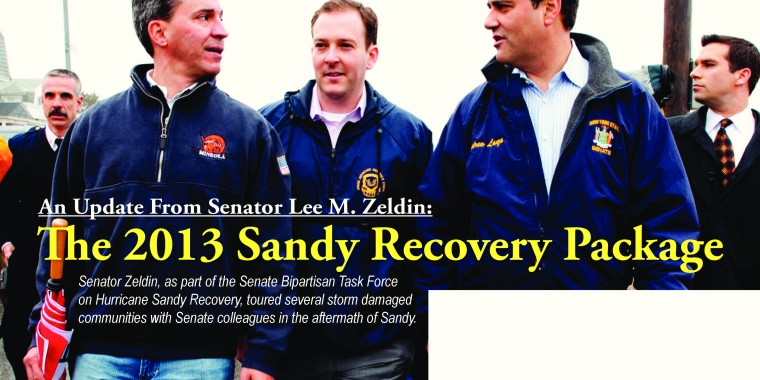

The 2013 Sandy Recovery Package

July 10, 2013