O'Mara praises legislative agreement to enact 'Jobs for Heroes' program to assist disabled veterans

Thomas F. O'Mara

March 20, 2014

-

ISSUE:

- Veterans

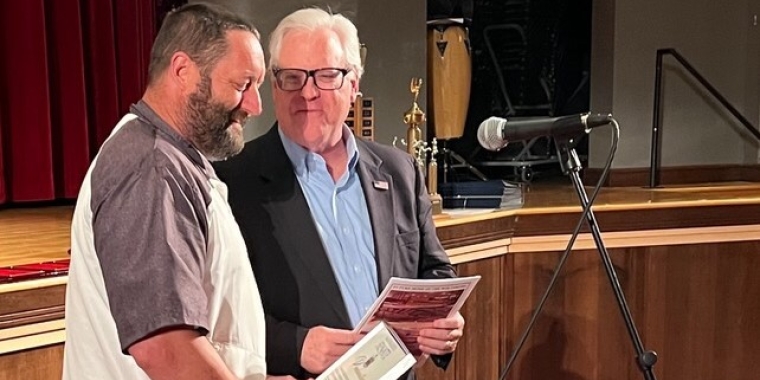

Albany, N.Y., March 20— Building on last year’s creation of a Hire-a-Vet tax credit to encourage businesses in New York State to hire returning veterans, the Legislature and Governor Andrew Cuomo today announced an agreement to enact legislation, patterned after legislation co-sponsored by State Senator Tom O’Mara (R,C-Big Flats) known as the “NY Jobs for Heroes Program,” to assist New York State businesses owned by service-connected disabled veterans.

The agreement was announced at a “Veterans and Military Families Summit” held by the governor in Albany today. The agreed-upon legislation will create a Division of Service-Disabled Veterans’ Business Development within the Office of General Services (OGS) to ensure, through set-asides and other initiatives, that six-percent of state contracts go to small businesses owned by service-connected disabled veterans.

O’Mara said that he will co-sponsor the soon-to-be-approved “Jobs For Heroes” program in the Senate.

“Last year I was proud to help sponsor and fight for the Hire-a-Vet tax credit, which we hope will make a difference for returning veterans coming home to a nation and a state where it’s tough to find a job,” said O’Mara. “Now we’re going to build on last year’s success and, this year, enact the ‘Jobs for Heroes’ program to more fully assist our disabled veterans who are self-employed or operate a small business. It’s another investment in the future of our veterans and serves to help honor their service and sacrifice.”

O’Mara highlighted federal Bureau of Labor statistics from 2012 showing that unemployment reached a staggering 20 percent for veterans under the age of 30 who recently returned home from Iraq and Afghanistan. Moreover, statistics show that a significant number of post/9-11 veterans report service-connected disabilities. Approximately 88,000 New Yorkers served in Afghanistan or Iraq.

Under the state’s Hire-A-Vet tax credit, which was approved last March as part of the 2013-14 state budget and takes effect this year, businesses become eligible for a state tax credit after they’ve employed a post-9/11 veteran for one year. The credit will equal up to 10% of a veteran’s salary – 15% of disabled veteran’s salary – with the credits equaling up to $5,000 for a non-disabled vet and $15,000 for a disabled vet.

One in seven veterans is self-employed or small business owners. New York has the fourth-highest number of veteran-owned businesses – trailing only California, Texas and Florida.