Senator Amedore Announces Details of Senate’s Budget Priorities

George A. Amedore, Jr.

March 12, 2015

Senator George Amedore today voted in favor of the Senate’s one-house budget proposal, which will provide an outline of the Senate’s top priorities as budget negotiations continue. The Senate’s plan creates a new property tax rebate program for middle-class homeowners, restores funding to school districts, and makes significant investments in New York’s aging infrastructure to create good-paying jobs and help attract new businesses.

“The Senate’s budget priorities will help reduce the cost of living and doing business in New York, and provide help to our seniors and veterans, hardworking families, and the most vulnerable members of our communities,” said Senator Amedore. “There is still a lot of work to be done, but the budget resolution put forward today is a solid foundation for a final budget that will help make New York more affordable for everyone.”

PROPER FUNDING FOR OUR SCHOOLS AND MAKING COLLEGE MORE AFFORDABLE

The Senate budget completely eliminates the $1 billion that remains of the Gap Elimination Adjustment (GEA) scheme imposed by Democrats in 2010, and increases state school aid over what the Governor proposed in his Executive Budget. The additional $1.9 billion school aid increase advanced by Senate Republicans is also distributed fairly and equitably to every region of the state.

The chamber’s one-house budget increases the per-pupil charter school aid by $150 over the Governor’s $75 hike, for a total per-pupil increase of $225, and accepts his recommendation to lift the charter school cap. To provide even more opportunities for school-age children, the Senate includes the Education Investment Tax Credit in its budget.

The budget also makes college more affordable for New York families by increasing community college base aid by $100 and raises the Tuition Assistance Program (TAP) ceiling to include families making up to $100,000 a year, rather than the current $80,000 income limit, benefitting an additional 15,800 students.

In addition, Senate Republicans propose doubling the tuition tax credit (from $400 to $800) which has not been increased in 15 years while college costs have steadily increased and doubling the allowable deduction (from $10,000 to $20,000). It also permits recent graduates to deduct 100 percent of the interest on their student loans for residents maintaining full compliance with the terms of their loan repayment plan.

PROPERTY TAX RELIEF FOR MIDDLE-CLASS TAXPAYERS

The Senate expands upon the Executive’s tax relief proposal by creating a new property tax rebate program. The rebate, when combined with the existing property tax freeze credit, will provide the average New York homeowner with a rebate check totaling $458. Along with the STAR exemption, homeowners would receive the most property tax relief in state history this year.

Under the Governor’s original plan tax plan, a majority of New York homeowners (nearly 2 million) wouldn’t receive a dollar in additional relief. In contrast, the Senate’s broader tax cut proposal would apply to all STAR eligible homeowners, or approximately 3.3 million people.

In addition, the Senate budget will make the statewide property tax cap permanent and also includes a constitutional amendment to cap state spending at two percent.

HELPING SMALL BUSINESS AND ECONOMIC REVITALIZATION

To help create jobs and grow our economy, the Senate will advance a $200 million small business package. Among other things, the Senate’s plan would increase the business income tax exemption from 5 percent to 10 percent for all businesses and farms that file under the personal income tax, have no more than $500,000 in business income, and at least one employee. This proposal would save small businesses and farms more than $125 million annually and positively impact more than 500,000 New York businesses.

In addition, this overall proposal would expand the Executive’s small corporation rate reduction to save 42,500 businesses a total of $40 million annually.

The Senate would completely eliminate the job-killing 18-a energy tax surcharge, which has been a main priority pushed by Senator Amedore, this year instead of in two years, saving homeowners and businesses $285 million over two years.

The budget includes funding for critical New York State infrastructure and revitalization needs, including $1.5 billion for upstate revitalization projects, and a 1-to-1 water quality infrastructure matching program for communities to leverage $1 billion from the state’s Clean and Drinking Water Revolving Loan funds. In addition, the Senate provides funding for rural broadband.

The Senate proposes $1.5 billion for highway and bridge capital projects as part of a new five-year road and bridge capital program – doubling the Executive’s proposal.

In addition, the Senate budget calls for $700 million for regionally significant economic development projects statewide to help create jobs, $25 million for Upstate transit capital projects and $50 million for the Main Street Revitalization program to assist local governments in cleaning up blighted areas.

As a result of this year’s severe winter, the Senate budget also adds $50 million for the Consolidated Local Streets and Highway Program (CHIPS).

BUILDING A BRIGHTER FUTURE FOR FARMERS

The Senate budget puts in place a multi-part “Grown in New York” agriculture plan to help meet consumers’ demands for locally-grown food, and support local farmers in their efforts to provide quality, fresh food and strengthen rural communities.

The farm plan would help farmers expand their markets by providing monies to create five local transportation cooperatives where farmers can arrange to move their products to New York City and other major populated areas and offer $250,000 in New York State Thruway Toll rebate aid to help lower the transportation cost of these goods.

In addition, the plan would continue to fund vital agriculture research, marketing and education programs, expand the young and new farmer initiatives, create a “Grown in New York” brand and provide financial incentives to encourage schools to utilize locally produced, healthy food choices.

PROTECTING OUR ENVIRONMENT

The Senate’s budget plan makes major new investments in New York’s environment, including a substantial increase in funding for the Environmental Protection Fund (EPF). Under the Senate’s plan, the EPF will be funded with $200 million to support critical environmental initiatives, clean air and water projects and open space preservation, and a new energy efficiency category will be created. This reflects a $38 million increase over last year.

“Passage of our budget today is the first step toward on on-time budget that will help reduce the cost of living and doing business in New York State,” said Senator Amedore.

####

Share this Article or Press Release

Newsroom

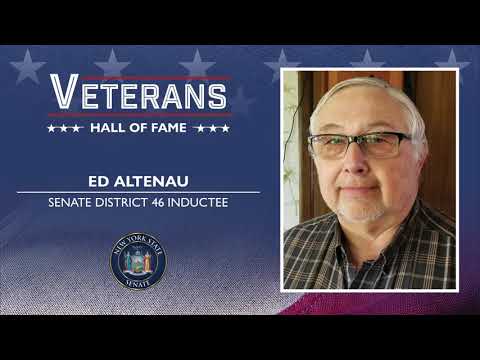

Go to NewsroomEd Altenau

November 11, 2020

STATEMENT FROM SENATOR GEORGE AMEDORE

April 2, 2020

SENATOR AMEDORE ANNOUNCES SCHOLARSHIP OPPORTUNITY

February 20, 2020