NEW LAWS TAKING EFFECT IN JANUARY 2016

December 28, 2015

As we rapidly approach the New Year, I wanted to touch base to let you know that a number of new laws will be soon taking effect. Measures that enhance the rights of women and protect those who are the most vulnerable to abuse and discrimination, as well as business tax cuts, and property tax relief for eligible veterans, will take effect in January 2016.

Women’s Equality Agenda

On January 19, 2016, seven of the eight bills comprising the Senate Women’s Equality Agenda will take effect, including:

Preventing Human Trafficking and Protecting Trafficked Victims (Chapter 368)

Ensuring Equal Pay (Chapter 362)

Stopping Discrimination Based on Family Status (Chapter 365)

Ending Pregnancy Discrimination in the Workplace (Chapter 369)

Preventing Housing Discrimination Against Domestic Violence Victims (Chapter 369)

Prohibiting Sexual Harassment in the Workplace (Chapter 363)

Removing Barriers to Remedying Discrimination (Chapter 362)

The remaining law that completed the Women’s Equality Agenda package will take effect April 1, 2016. This measure creates a pilot program that would enable domestic violence victims to seek temporary orders of protection through electronic means rather than having to appear in person. (Chapter 367)

Business Tax Cuts

Starting on Jan 1, 2016, the Business Income Tax rate will be lowered from 7.1 to 6.6 percent, saving businesses a total of $125 million. Also starting Jan 1, 2016, New York State’s small business exemption increases to 5 percent for sole proprietors and farmers with at least one employee and a federal adjusted gross income that does not exceed $250,000. Exemption increases have been phased in since legislation was passed in 2013 and will ultimately save small businesses a total of $61 million.

Help for Veterans

A new law that takes effect Jan 2, 2016, helps reduce the local property tax burden for veterans by authorizing an increase in limits to the real property tax exemption. Municipalities have the option of offering these exemptions to help veterans afford owning a home. The new limits take into account rising property values so that the savings offered with tax exemption, can continue to help eligible veterans. (Chapter 381)

It was a very productive year in the State Legislature, and I am looking forward to an even more productive 2016 Legislative Session. For more information on these important new measures, please feel free to contact my office at 845-344-3311.

I wish you and your family a safe, healthy, and happy New Year!

Share this Article or Press Release

Newsroom

Go to Newsroom

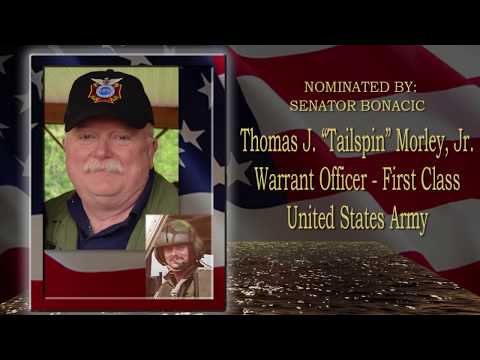

Thomas J. "Tailspin" Morley, Jr.

May 15, 2018