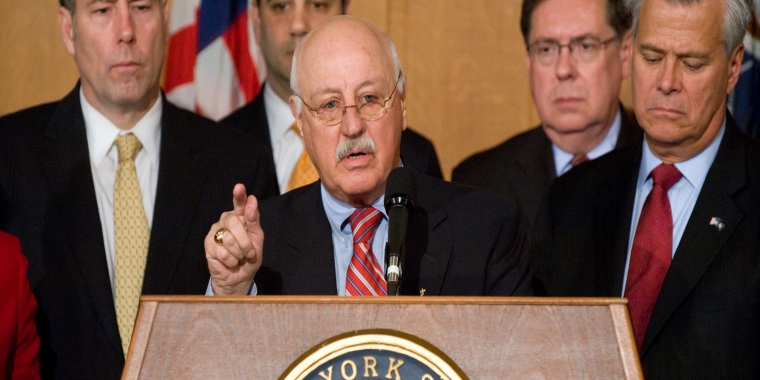

Senator Ken LaValle Releases Highlights of Senate Budget Resolution

Kenneth P. LaValle

March 13, 2015

-

ISSUE:

- Taxes

March 12, 2015 – Today, Senator Ken LaValle reports that the New York State Senate has passed it’s 2015 Budget Resolution, which addresses the priorities of Long Island families. The document now becomes the framework for budget negotiations with the Assembly and the Governor towards completing the NY State Budget.

Senator LaValle said, “In January, I promised to continue to make meaningful changes that will ease the burden on hard-working taxpayers. This Budget resolution calls for a new property tax rebate to be paid directly to homeowners, in addition to making the 2% property tax cap permanent. It’s critically important that we continue to provide tax relief for families”

“We increase local school aid by $1.9 billion to fund quality education for our children. Additionally, we are seeking to eliminate the GEA in its entirety, which was a cut in local school aid that put a strain on many school budgets.” he continued.

Senator LaValle said, “I have continued to fight to make college more affordable for current students. This financial plan includes an increase in the TAP ceiling to help an additional 15,800 students afford college. The resolution also doubles the tuition tax credit to enable a 100 percent deduction of the interest on student loans to help reduce a student’s debt load.” Senator LaValle concluded, “The Senate Budget Resolution is a fiscally responsible proposal that would cut taxes, add tax stability for Long Island families, create new jobs, invest in local education, provide relief for college students, and preserve the environment.”

NY Senate Budget Resolution Highlights

The plan creates a new property tax rebate program that will provide the average New York homeowner with a check for $458. When combined with the existing freeze credit and the STAR exemption, it is a very ambitious property tax relief proposal.

Provides the middle-class tax stability by making the 2% property tax cap permanent.

Offers historic new opportunities for students to allow them to succeed and follow their dreams. This increases school aid by $1.9 billion over last year, and completely eliminates the $1 billion that remains of the Gap Elimination Adjustment (GEA) that was imposed in 2010.

To make college more affordable for New York families, the Senate increases community college base aid by $100 and raises the TAP ceiling to include families making up to $100,000 a year, rather than the current $80,000 limit – benefitting an additional 15,800 students.

The Resolution would double the tuition tax credit, which hasn’t been increased in 15 years; double the allowable deduction and permit recent graduates to deduct 100 percent of the interest on their student loans to relieve more student debt load.

The plan improves the business climate for job creators and job seekers by supporting critical infrastructure and technology programs. A $200 million small business package will help create new jobs and grow our economy.

Eliminates the 18-a energy tax surcharge to save taxpayers and businesses $285 million over 2 years.

Makes major new investments in New York’s environment, including a substantial $38 million increase in EPF funding. The EPF will be funded with $200 million to support critical environmental initiatives, clean water and air projects, open space preservation, and a new energy efficiency category will be created.

Provides another $1.5 billion for highway and bridge capital projects as part of a 5-year road and bridge capital program.

The Resolution proposes $700 million for regionally significant economic development projects identified by local leaders, money for broadband, and another $50 million in CHIPS funding to rebuild our roads after an historically severe winter.

To provide even more opportunities for school-age children, the Senate includes the Education Investment Tax Credit in its budget.

The Senate supports enhanced disclosure to ensure greater transparency and accountability to restore the public’s trust in government.

Advances a constitutional amendment to cap state spending at 2 percent so we can build on financial gains and secure a brighter future.

The passage of the Senate’s budget resolution is an important step in continuing to make progress toward a fifth consecutive on-time budget.

###

Share this Article or Press Release

Newsroom

Go to NewsroomStay Informed - Emergency Information Alert

March 15, 2010

Senator Lavalle Fights for Property Tax Relief Plan –

March 11, 2010