Senator Panepinto’s Green Home Tax Exemption Bill Unanimously Passes Local Government Committee

Marc Panepinto

March 17, 2015

-

ISSUE:

- Towns or Counties

Panepinto’s homeowner tax relief legislation incentivizes critical growth in Erie County’s recovering housing market

ALBANY, N.Y. – Today, Senator Marc Panepinto advocated for his tax relief legislation (S.3644) before the Senate Committee on Local Government on which he is the Ranking Member. After its unanimous passage, he released the following statement:

“As the Ranking Member of the Local Government Committee, I am proud that my first piece of legislation passed addresses environmental responsibility and the crushing burden that is our property tax climate. By authorizing a green home tax exemption in upwards of 35%, the State not only encourages the use of renewable energy and resources but delivers on incentivizing much needed growth in Erie County’s recovering housing market. I hope that the full Senate will consider the passage of this critical legislation.”

S.3644 accomplishes the following:

- Establishes a Green Development Home Tax Exemption for Erie County.

- Authorizes a 35% exemption from local real property taxation for homes that are part of green developments as LEED (Leadership in Energy and Environmental Design) certified or certified by the National Association of Home Builders (NAHB).

- Leadership in Energy and Environmental Design (LEED) is a green building certification program that recognizes best-in-class building strategies and practices, developed by the U.S. Green Building Council (http://www.usgbc.org/LEED).

- Nation Association of Home Builders (NAHB) is a trade association that helps promote the policies that make housing a national priority.

Share this Article or Press Release

Newsroom

Go to NewsroomTHANKSGIVING ESSAYS AND CONTRIBUTIONS SD 60

November 22, 2016

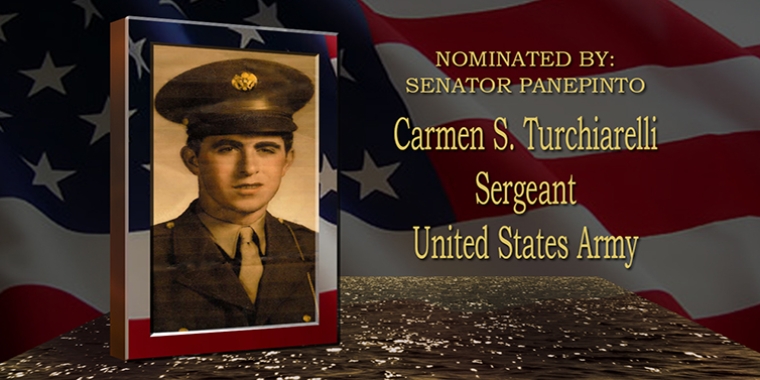

Carmen S. Turchiarelli

May 20, 2016

Debora M. Hayes

May 11, 2016

Earth Day 2016 Poster Contest: District 60

April 14, 2016