Ortt: Senate Budget Builds a Brighter Future for Middle-Class Taxpayers

Robert G. Ortt

March 14, 2015

Senator Supports New Property Tax Rebate Program For Middle-Class Homeowners

The Senate’s one-house budget proposal, which Senator Rob Ortt (R,C,I – North Tonawanda) recently voted in favor of, outlines some of the Senate Republican Majority’s top priorities, including providing relief for middle-class taxpayers.

The “Brighter Future” budget plan creates a new property tax rebate program for all STAR-eligible homeowners. This rebate expands upon the Governor’s Executive tax relief proposal and would provide the average New York homeowner with a $458 rebate check.

If combined with the existing property tax freeze credit and the STAR exemption, the tax rebate program would provide homeowners with the most property tax relief in state history this year.

“By controlling taxes and spending, hardworking, overburdened taxpayers in Western New York will be able to reap the benefits they very much deserve,” said Sen. Ortt. “Working class and middle-class families in the region have struggled for far too long. This sensible tax relief program will not only keep our families in Western New York, but also help them thrive.”

The Senate’s tax cut proposal would apply to approximately 3.3 million people throughout the state who are currently eligible for STAR. That’s a stark difference compared to the Governor’s original tax plan where nearly 2 million New York homeowners would not receive a dollar in additional relief.

In addition, the Senate budget would make the statewide property tax cap permanent to limit further hikes, particularly for local homeowners, including those in Niagara County, who pay some of the highest property taxes compared to home values in the nation.

The one-house budget resolution also includes a constitutional amendment to cap state spending at two percent.

Share this Article or Press Release

Newsroom

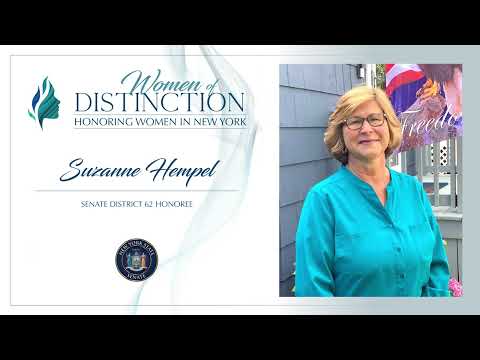

Go to NewsroomSenator Ortt 2022 Woman of Distinction

August 26, 2022